Instant Brands, the maker of the popular Instant Pot pressure cooker and other kitchen appliances, filed for chapter 11 bankruptcy on Monday.

The day after I ruined a bunch of rice trying to cook 800g in an Instant Pot for the first time the company files for bankruptcy. Damn.

— Kevin (@KevinLeafed) June 13, 2023

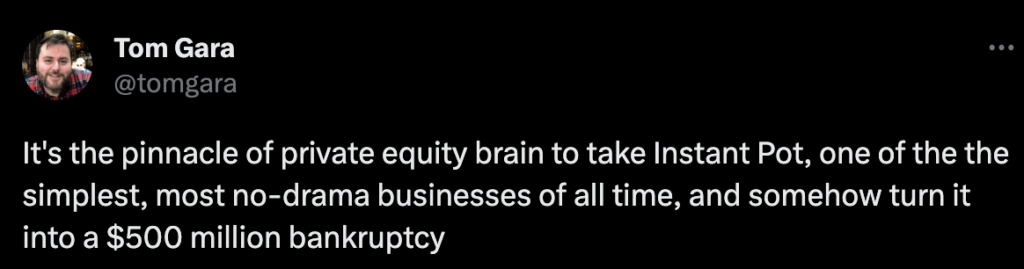

The Illinois-based company has struggled with declining sales and financial turbulence exacerbated by consumers’ reduced discretionary spending amidst inflation. The decision to file for bankruptcy came after a prolonged period of economic strain, with Instant Brands registering more than $500 million in both assets and liabilities.

In 2019, Cornell Capital, a private equity firm, purchased Instant Brands and merged it with kitchenware company Corelle Brands. However, despite this, the company has been unable to reverse the downtrend in its sales performance; the firm’s other product lines, including Pyrex and Snapware, have been insufficient to offset the dwindling popularity of the Instant Pot cooker. Over the past few months, the company has collaborated with restructuring advisors to address its financial situation and enhance its balance sheet, but the results have been lackluster.

the thing about the instant pot bankruptcy for me is that, yeah, it’s another private equity firm ruining everything, of course it is. but not only do they own instant pot, they own goddamn pyrex. PYREX! how do you run out of money while literally making pyrex lmao

— liz ten eleven (@selectric401) June 13, 2023

I feel like every other person in America owns an Instant Pot, so the bankruptcy thing is confusing.

— Budini (@Budini) June 13, 2023

According to a recent report by S&P Global, Instant Brands’ net sales in Q1 2023 experienced a decline of 21.9% compared to the same period in the previous year. This was the seventh straight quarter where the company witnessed year-over-year sales contraction. The S&P report attributed the poor performance to “lower discretionary spending on home products, lower retailer replenishment orders for its categories, and some retailers moving to domestic fulfillment from direct import.”

Instant Brands CEO Ben Gadbois acknowledged the challenges posed by tightening credit terms and increasing interest rates, asserting that these factors have impaired the company’s liquidity and rendered its capital structure unsustainable. In spite of the obstacles, Gadbois remained optimistic about the Instant Pot product’s longevity while recognizing that “no product stays at a phenom level forever.”

Instant Pot?

— Elliott Price (@ElliottFPrice) June 13, 2023

One step at a time

Canada just getting used to delivered pot

The journey of Instant Brands started in 2009 when Robert Wang, Yi Quin, and three other partners established the company in Canada, before selling it to Cornell Capital a decade later.

Information for this briefing was found via the Wall Street Journal and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.