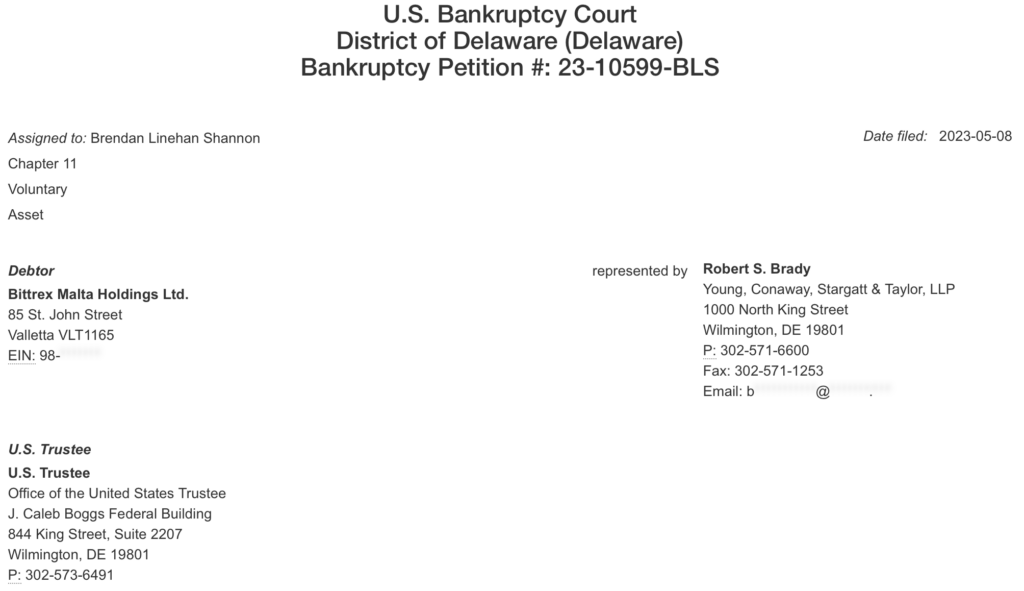

Bittrex Inc, a cryptocurrency exchange, filed for bankruptcy on Monday, three weeks after the Securities and Exchange Commission (SEC) accused it of operating an unregistered securities exchange.

The firm has halted operations in the United States since April 30, and the company stated that the bankruptcy filing would have no effect on Bittrex Global, which serves consumers outside the United States.

The crypto exchange stated that it was still holding crypto assets belonging to US customers who had not withdrawn funds by April 30.

Those assets are “safe and secure,” and Bittrex stated that it intends to petition the bankruptcy court for a limited re-opening of user accounts so that the cryptocurrency can be dispersed to customers.

Next: Coinbase?

On April 17, the SEC filed a lawsuit against Bittrex, saying that former CEO William Shihara pushed crypto asset issuers looking to make their tokens available on the company’s platform to remove public remarks that could lead regulators to investigate those token sales as securities.

Bittrex’s overseas subsidiary, Bittrex Global GmbH, was also charged by the SEC for failing to register as a national securities exchange in conjunction with its operation of a single shared order book alongside Bittrex.

The move pushed the crypto exchange further to stop its domestic operations in the United States. All these came after the SEC issued its infamous Wells notice–a document that’s usually a precursor of a lawsuit by the regulatory agency–on the firm.

When Bittrex received the Wells Notice notification, it was already planning to close its U.S. operations, according to David Maria, the company’s general counsel, citing the difficulty of cooperating with US regulators who have launched enforcement action against over 100 crypto defendants in the last six years.

Bittrex, which agreed to pay $29 million in fines for anti-money laundering and sanctions offenses last year, blamed the move on “continued regulatory uncertainty,” adding that American regulators are unwilling to advance “sensible policies that will foster innovation and enhance the American economy.”

Seemingly drawing a similar pattern, Coinbase is currently embroiled with regulatory hurdles after it received a Wells notice as part of the SEC’s intensifying crackdown on crypto firms, arguing that their digital assets are considered securities and must be regulated under the purview of the agency.

In response, the company did not hold back in the battle it has had in seeking regulatory certainty from the commission, commenting that they provided two different potential registration models for the exchange, and others in the crypto space.

“We developed and proposed two different registration models. We spent millions of dollars on legal support to build these proposals and repeatedly asked for the SEC’s feedback. We got none. We also reiterated that we stand by our listings process – we don’t list securities today – and repeatedly invited the SEC to raise any questions about any asset at all on our platform. They raised none,” they wrote.

Like Bittrex, Coinbase is starting to signal a US exit, citing regulatory issues. The firm has recently secured a license to operate in Bermuda, indicating that the company is doubling down on plans to expand its foreign operations at a time when US regulators have proven unfriendly to the crypto industry.

“I think the U.S. has the potential to be an important market for crypto, but right now we are not seeing that regulatory clarity that we need,” CEO Brian Armstrong said at Fintech Week in London. “I think in a number of years if we don’t see that regulatory clarity emerge in the U.S. we may have to consider investing more elsewhere in the world.”

#Bittrex is bankrupt.$COIN is headed that direction.

— Parrot Capital 🦜(Follow me & read the pinned 🧵) (@ParrotCapital) May 8, 2023

You were warned. 🦜 pic.twitter.com/RxtqvTyaTO

However, unlike Bittrex, Coinbase made a preemptive strike and took it upon itself to take the SEC to court first. The crypto exchange asked a US federal judge to order the SEC to reply to its earlier regulation petition within seven days in a narrow action.

In July last year, Coinbase requested that the SEC propose and adopt guidelines to define which digital assets are securities and how securities laws would apply to digital assets.

“Coinbase does not ask the Court to instruct the agency how to respond. It simply requests that the Court order the SEC to respond at all,” Coinbase said in a federal court filing.

Coinbase even doubled down and made a public video message to the SEC, responding to the agency’s Wells notice, asking the agency not to pursue enforcement action against the business for the sake of the SEC.

In its Wells submission in response to SEC’s issuance of its infamous Wells notice, Coinbase warned that “if the Commission pursues this matter, it will face a well-resourced adversary that will necessarily be motivated to exhaust all avenues.”

“Coinbase has never wanted to litigate with the Commission. The Commission should not want to litigate either. Litigation will put the Commission’s own actions on trial, erode public trust cultivated over decades, undermine incentives for market participants to engage with the Commission in good faith, and present significant risks to broad aspects of the Commission’s enforcement program,” the crypto exchange said.

Arguably, however, given the recent examples made out of SEC’s intensifying crypto crackdown, observers see that this Wells response doesn’t bode well for Coinbase’s prospects. The heart of the matter will still go back to defining/disproving the crypto firm’s services as securities, despite public pronouncements of either side.

Information for this briefing was found via Reuters and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.