The sudden rug-pulling of the heavily hyped meme coin “BALD” has caught the attention of the crypto community, with speculation arising about the possible involvement of Sam Bankman-Fried, the founder of failed crypto exchange FTX and sister trading firm Alameda Research.

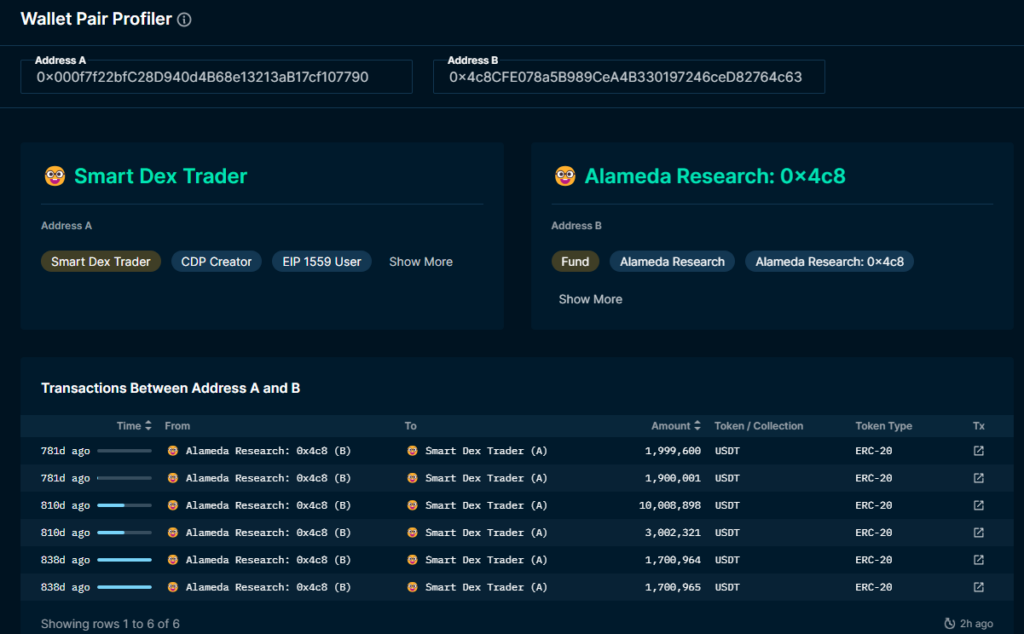

Blockchain analysts on Twitter, later validated by CoinDesk, revealed intriguing on-chain data indicating interactions between BALD’s deployer contract and a wallet linked to Alameda Research.

Igor Igamberdiev, head of research at Wintermute, identified another wallet (0xccFa05) as belonging to Alameda, pointing out the owner’s strong technical capabilities and expertise in decentralized finance (DeFi) activities, including early involvement with dYdX, Oasis, SushiSwap, Yearn Finance, and Cream.

Although the evidence pointed towards someone associated with Alameda, it was deemed unlikely to be Bankman-Fried himself due to the lack of direct connections with other players in the industry. The community pondered whether the person behind the transactions was Bankman-Fried or Sam Trabucco.

7/12

— Igor Igamberdiev (@FrankResearcher) August 1, 2023

Given the track record and the lack of contacts with other players (even 3AC actively interacted with BlockFi, Genesis, etc.), then we can point the finger toward someone from Alameda

And let's try to answer probably the most critical question, SBF or @AlamedaTrabucco? pic.twitter.com/Y0wNKg5Lhh

Sam Bankman-Fried = BALD?

In an X (formerly Twitter) thread posted by user @hype_eth, where a series of connections were pointed out, it was suggested that Bankman-Fried had a potential involvement in this $100-million market cap digital coin scheme while he was on house arrest in his parent’s basement.

Tweets highlighted several points of concern, which have since garnered significant attention and speculation within the cryptocurrency community. The user claims there were thousands of ETH transactions between FTX and BALD, raising suspicion of a possible link between the two entities.

The timeline of onchain activity was said to align with Bankman Fried’s court dates and bail periods, raising questions about the legitimacy of his actions during those times. The thread claimed that he was seen using a VPN.

– Bald deployer DYDX posts sound like SBF

— hype (@hype_eth) July 31, 2023

– Onchain activity times line up with court dates/bail

– We know SBF was doing stuff through VPN recently

(2/x) 👇

In addition, the thread also pointed out that the BALD deployer’s tweets exhibited a striking resemblance to Bankman-Fried’s sentence structure and that the deployer was the biggest dYdX farmer.

Using "correct" as a single word response:https://t.co/QFEKlkRTjH

— hype (@hype_eth) July 31, 2023

Last week, Bankman-Fried was issued a gag order by a judge in his ongoing fraud trial following allegations made by prosecutors that he leaked personal information of his former business partner and girlfriend, ex-Alameda Research CEO Caroline Ellison, to the press in an apparent effort to discredit her as a witness in his ongoing fraud trial.

Prosecutors further argued that home confinement was insufficient to control Bankman-Fried’s behavior, contending that he had repeatedly violated restrictions. Allegedly, he used messaging apps with auto-deleting and encrypted texts and installed a VPN to access restricted content.

Although, it is noteworthy that as a condition of his bail, Bankman-Fried’s internet access is closely monitored and limited to specific categories of websites, including news, sports, and educational platforms. In compliance with this condition, Bankman-Fried’s parents have signed an affidavit stating that they will install monitoring software on their home connection to regulate his internet usage. Additionally, the former FTX executive is only allowed to use a basic flip phone during this period.

The X user also noted that the official project Serum account on Twitter allegedly changed its name to @0xLukaeth and promoted the BALD project, potentially indicating some involvement or endorsement. There were also claims of connections between the BALD deployer and a UST depegger on Binance that reportedly contributed to the collapse of LUNA.

Finally, the thread also mentioned a link between a Binance deposit address and a wallet that allegedly interacted heavily with Alameda and Blacklisted USDT addresses.

– Bald deployer linked through binance to UST depegger that helped collapse $LUNA:https://t.co/aMvp7yev9i

— hype (@hype_eth) July 31, 2023

(5/x) 👇

What is BALD?

Over the weekend, the allure of meme coin fortunes on Coinbase’s new layer-2 blockchain Base attracted a staggering $68 million in ether (ETH) and generated over $200 million in trading volumes. Traders eagerly bought BALD tokens, pushing the market cap to $85 million by late Sunday. Some individuals, like @cheatcoiner, reported making over $1.4 million from an initial $500 investment.

However, the excitement quickly turned to disappointment on Monday when BALD deployers abruptly withdrew millions of dollars in liquidity from the token’s trading pairs without any prior warning. This sudden move left thousands of holders at a loss and caused prices to plummet by up to 90% as they rushed to sell their holdings.

Ironically, all of this drama unfolded on Base, a blockchain that has yet to officially open to the public. Developed by Coinbase on OP Stack, Base launched its testnet in January and opened to builders in mid-July. Until Sunday, traction had been limited, but the frenzy surrounding BALD sparked a sudden influx of capital and users to the platform.

In the middle of this brouhaha, the crypto community is on the edge of awaiting the second wave of an FTX-sized implosion, especially after the failed crypto exchange recently announced its plans to restart its operations.

you sure can but $BALD is just a side show. the real FTX part 2 is about to be $CRV.https://t.co/XVmhwPujNt

— ⚯ M Cryptadamus ⚯ | @cryptadamist@universeodon.com (@Cryptadamist) August 1, 2023

1) What https://t.co/GZmH3UIobK

— Chairman (@WSBChairman) August 1, 2023

In January, Bankman-Fried pleaded not guilty to eight federal charges, with the trial scheduled for October. His troubles began in November after CoinDesk reported suspicious financial dealings between FTX and Alameda Research, leading to his subsequent resignation from FTX and the company’s filing for bankruptcy. During the arrest, several other high-ranking executives at both firms were also taken into custody.

In total, Bankman-Fried is facing 13 counts, including securities fraud, wire fraud, and campaign finance violations. Apart from the eight charges he initially pleaded not guilty to in January, he is also accused of overseeing the transfer of $40 million from an Alameda account to a private account believed to be associated with Chinese officials in November 2021.

In June, federal prosecutors in New York have made a surprising offer in the case. In an attempt to expedite proceedings, they propose dropping several criminal charges against Bankman-Fried for now, on the condition that they can be tried later.

Following a recent ruling in the Bahamas, where Bankman-Fried has been challenging additional charges, prosecutors have decided to sever five of the 13 charges. These charges include allegations of bank fraud and bribery of the Chinese government.

Information for this briefing was found via CoinDesk and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.