It appears that in the wake of the recent announcement of private operator Redecan being acquired by Hexo Corp (TSX: HEXO) (NYSE: HEXO) in a massive $925 million transaction, other well-known private operators are looking to make their exit as well. The Deep Dive has recently reviewed materials prepared on June 1 suggesting that BC-based Tantalus Labs may be the next private licensed producer to be put up on the selling block.

While the materials in question don’t outright state that it is in fact Tantalus that is being referring to in the two page “teaser” pamphlet prepared by Eight Capital, numerous items point to it as being such. Officially referred to as “Project Sunlight,” the firm in question was reportedly founded in 2012, operates in Maple Ridge, and contains a CEO named to Marijuana Venture’s Top 40 Under 40 – all signs that point to the firm in question being Dan Sutton’s Tantalus Labs.

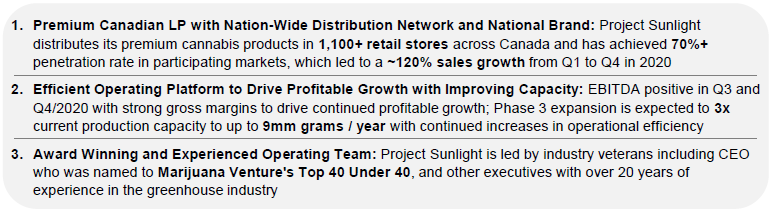

The cut sheet on the firm doesn’t directly state what the end game is currently for the firm with respect to whether they are looking to go public or simply be acquired by another (likely public) operator. Several insights are provided on the firm however that provide a glimpse into the operations of the company, including:

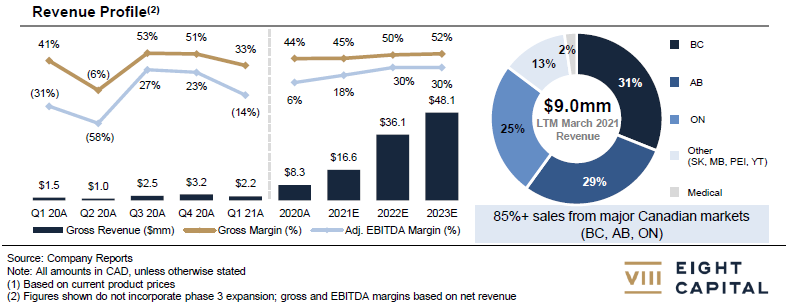

- Positive adjusted EBITDA in Q3 and Q4 of 2020, however this figure went negative in Q1 2021.

- Distribution via 1,100 retail stores, with penetration beyond 70% in participating markets. Market share, as per the cutsheet, is stated to be ~1% in participating markets.

- Average revenue per gram of $5.86 in Q1 2021, while cost per gram is stated as being $2.27.

- Ownership consists of 60% attributable to founding shareholder group and management team.

- 75,000 square foot facility currently operated, with production capacity of up to 3,000 kg of dried cannabis per year.

Speaking specifically to the financials of Tantalus, the company saw revenues of $8.3 million in 2020, and is currently projecting that it will precisely double that figure to $16.6 million in 2021. Notably, revenue figures are reported on a gross basis with excise taxes, despite Sutton recently citing excise taxes as a major pain point, wherein he commented that he “often [has] to pay upwards of 25% of [their] top line revenue in excise taxes.”

While a full balance sheet was not provided within the two pager, it was outstanding that the firm currently has approximately $6.6 million in debt. Debt is made up of a 10.85% secured mortgage held by a related party that currently has $3.3 million in principal and $2.3 million in accrued interest outstanding, as well as a $1.0 million unsecured bridge loan bearing 12% interest held by 8 related parties.

The cut sheet also highlights the management team, suggesting that the firm is looking to be wholly acquired as a subsidiary, or simply go public on its own. Hard details in terms of the purpose of the cut sheet were not provided. Whatever the intent, it appears that private cannabis operators in Canada are looking to hit the cash out button.

Information for this briefing was found via reviewed documents and the companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.