On May 28th, Hexo Corp (TSX: HEXO) (NYSE: HEXO) announced yet another acquisition. The company has entered into an arrangement to acquire another Canadian licensed producer, Redecan, for a whopping $925 million via a combination of shares and cash. Redecan will own ~31% of the combined entity. This is the third acquisition the company is making in a few short months. They started it off in February with the $235 million purchase of Zenabis, then in early May, they announced the purchase of 48North for $50 million.

Canaccord lowered their 12-month price target to C$9 from C$9.50 and reiterated their hold rating on HEXO. Bottomley writes, “we believe the ability to secure lasting long-term adult-use market share will eventually separate the winners and losers in the space,” and that they will be watching out for any integration errors made by HEXO’s management. This will be easy to notice as they will be watching to see if HEXO can maintain and grow its market share in Canada.

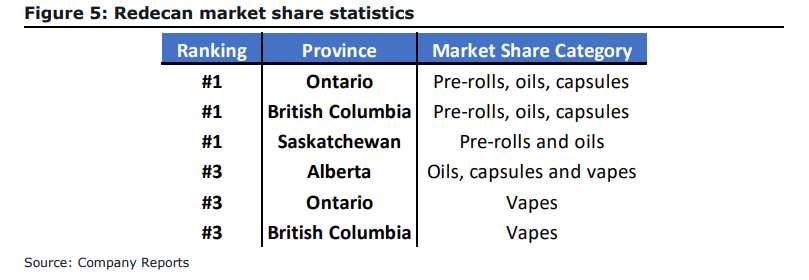

Bottomley reiterates HEXO’s claims as to justify spending $925 million on this company, but then gives us some additional information. He says that Redecan “has amassed leading market share in the prerolls, capsules and oils categories and top-three market share in ON/AB/BC vape products.”

He then makes note that HEXO provided absolutely no tangible or even valuable information around the financial health of the company but rather they released specific data points which, “point to the fact that the company is one of the ‘healthier’ licensed producers in the Canadian market.”

Bottomley gives us his updated 2021 and 2022 estimates. This is including both Redecan and 48North, for which there is barely any material increase in revenues for 2021 while the company figures out how to right-size its operations. Bottomley expects that by 2022 the company will properly integrate the new operations, and that’s when the step function happens. By 2022 Bottomley believes HEXO will capture 17% of the total adult-use market in Canada, which will increase to 20% “over the long term.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.