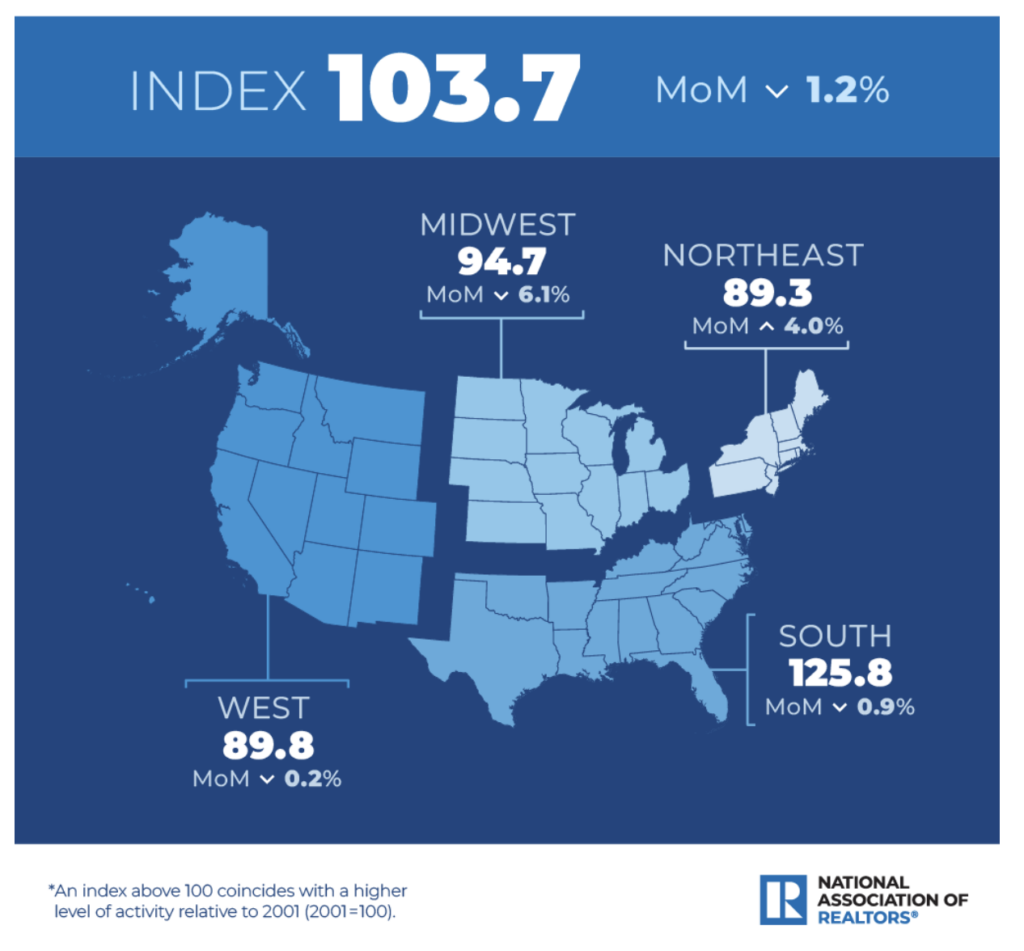

Pending home sales across the US were down for the fifth straight month, signaling that what were historically high market conditions are abating as higher borrowing costs and surging home prices bite into Americans’ pocketbooks.

Latest data from the National Association of Realtors shows that pending home sales slumped 1.2% between February and March, and were down 8.2% from the same month a year ago, marking the tenth consecutive month of year-over-year declines. Annual pending home sales were down across all regions in the US, while on a monthly basis only the northwest region of the country saw an increase in contract activity.

“The falling contract signings are implying that multiple offers will soon dissipate and be replaced by much calmer and normalized market conditions,” explained NAR chief economist Lawrence Yun. “As it stands, the sudden large gains in mortgage rates have reduced the pool of eligible homebuyers, and that has consequently lowered buying activity. “The aspiration to purchase a home remains, but the financial capacity has become a major limiting factor.”

Yun forecasts the 30-year fixed mortgage rate will hit 5.3% by the fourth quarter of 2022, and then rise to around 5.4% in the following year. He expects inflation will average at around 8.2% for 2022, before moderating to 5.5% in the second half of the year. The NAR found that higher mortgage rates and price appreciation have caused Americans’ mortgage payments to increase 31% year-over-year in March.

However, it’s not just existing and new homes that have been subject to substantial price appreciation; rental properties, too, have clawed away at consumers’ pocketbooks, forcing some renters to explore homeownership. “Fast-rising rents will encourage renters to consider buying a home, though higher mortgage rates will present challenges,” said Yun. “Strong rent growth nonetheless will lead to a boom in multifamily housing starts, with more than 20% growth this year.”

Information for this briefing was found via the NAR. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.