For our purposes, we’re defining discovery-stage exploration equities as those with no established mineral resources, doing the prospecting and drilling required to identify an economic mineral deposit. Often, these properties host historic resources compiled by a previous operator in the era when a promoter could open the office window to fill the office with construction noise, then yell into the phone that he’s, “UP AT THE PROPERTY WATCHING THE DRILL TURN RIGHT NOW, MR. JOHNSON, AND I’VE NEVER SEEN ANYTHING QUITE LIKE THIS STUFF COMING OUT!”

Those resources don’t count, because they were compiled before National Instrument 43-101; a sort of geologically grounded rules of engagement meant to put a scientific choke on the currents of hot air that these equities have been known to soar on. That isn’t to say that all that action doesn’t deserve to be there in the discovery phase; a piece of dirt in the middle of nowhere going from being worth nothing to being worth billions on the strength of a drill hole is one of the most exciting experiences in investing. But it’s rare and it’s random and the practical approach to getting involved starts with triage. Investors improve their odds by identifying what to pass on early.

While the rising tide of metals prices does lift all boats, it doesn’t lift them all equally, because they aren’t all built equally. A careful inspection of the hulls can tell a lot about the rate they’re likely to take on water.

Exploration is a war of attrition and the thing being attrited is the company’s cap table. With no income, and nothing to borrow against, exploration juniors have to issue shares to fund their activities. The companies who manage to create more market interest in dollar terms than the value of the stock printed have a period in which early entries can cash out. It often matters how early, and we’ll get to that in part two, but first, let’s have a look at one of the classic archetypes.

Nexus Gold

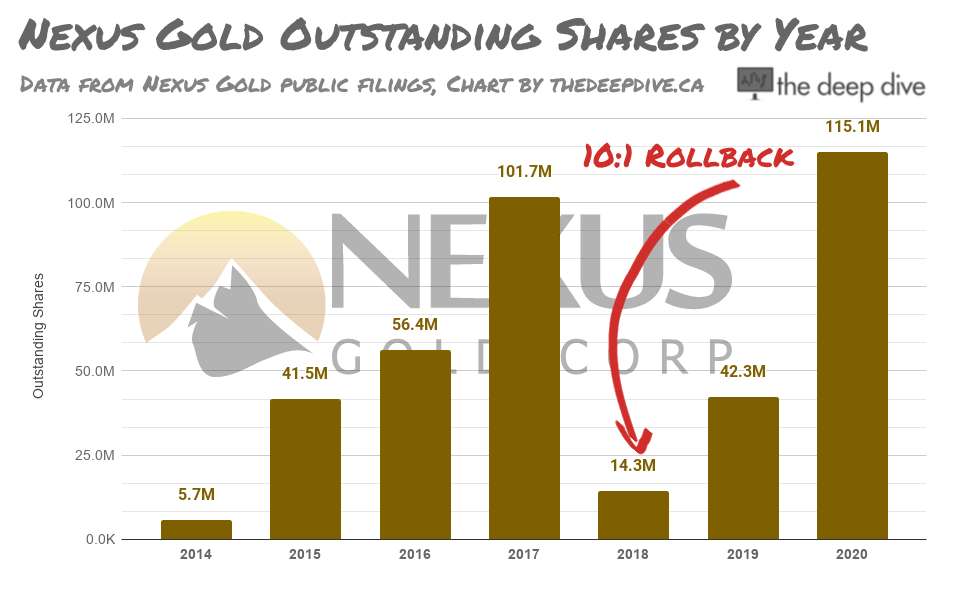

Some hulls have so much patching in the fiberglass that one might wonder how they ever move, if they ever did move. Nexus Gold (TSXV: NXS) is a name that’s been around forever, and always seems to be acquiring a new property, or raising a small amount of money at pennies a share. It underwent a 10:1 share consolidation in 2018, having spread itself thinner than the Zimbabwean treasury, and has already managed to print its way to 169 million two years later. NXS closed at a lofty 52 week high of $0.12 Monday, and spent all of July coming up off the mat from $0.06 on abnormal, but erratic volume.

Much of this can be attributed to Nexus’ brand recognition in the aforementioned rising tide. The company tends to squeeze every drop of price momentum it can out of any exploration activity it does, and are presently building anticipation over some recently completed drilling on its Mackenzie gold project in Red Lake. We don’t know how that program turned went or how the assays will turn up, nobody does, but Nexus has set some expectations by dusting off a hole completed by a previous operator that turned up 7.48 g/t gold over an 8 meter core length back in 2005.

When the results do come out, the buying they generate will be tasked with soaking up 14 million shares issued at $0.03 in a private placement, 11.5 million shares issued for mineral properties and another million shares issued for stock options and services rendered, and that’s just year to date through April. Since then, Nexus has done two more private placements to print an aggregate total of 20 million more shares at $0.05 and $0.055.

Various property vendors, contractors and promoters have been talked into taking Nexus paper at some value or another, and are surely looking forward to an opportunity to finally turn it into money. Naturally, an eye popper of a gold intersection would gain sufficient interest, but it’s hard to imagine a middling one moving all that weight. Mathematically speaking, this company creates stock at a faster rate than the market buys it.

Strung out cap tables like Nexus aren’t hard to spot, and the idea that they’re best avoided has worked itself into the general gold-stock punter wisdom. Amateur analysts are known to warn that “there are a lot of shares outstanding,” in a company like Nexus, ignoring the dynamic of practical value of what those shares bought the company and, crucially, their value to their holders. This lack of awareness isn’t likely to go away ever, because leaky crafts still manage to work the bilge pumps overtime and continue to float on the rising tides. It’s just that the sharper investors understand that their relative chances might be better on something more seaworthy.

Stay tuned for part 2, where we take a look at the types that look fresher, but are up against their fair share of drag.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to these organizations. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Maybe so, but how many gold mining companies were struggling to survive until recently?