This morning BMO Capital Markts raised their 12-month price target on Ivanhoe Mines (TSX: IVN) to C$10 from C$9 and reiterated its Outperform rating on the stock. This comes a day after TD and Canaccord Genuity raised their price targets from C$6.50 to C$7 and C$5.50 to C$7, respectively.

These upgrades come off the back of Ivanhoe releasing their economic results of the independent integrated development plan for their Koma-Kakula copper project and just recently having their investor day, which BMO’s Andrew Mikitchook says “highlighted the rapid pace of construction and underground development with less than 12 months to production and accelerating derisking.”

Mikitchook says that Ivanhoe is their top pick for the few new copper mines in construction and says “the Kamoa-Kakula complex will be one of the largest mines worldwide.”

There is a small handful of key takeaways from the recent investor day that has been highlighted by Mikitchook. The first thing he emphasized is that the 3.8 million tonnes per annum Kakula mine is currently under construction and is expected to start production in the third quarter of 2021 and remains fully financed via Ivanhoe’s treasury. The subsequent expansions are expected to be funded by Kakula’s cash flows. The second important takeaway from the investors’ day is that Ivanhoe evaluated the acceleration of their expansion from 3.8 to 7.6 million tons per annum to be the second quarter of 2022, an improvement from the first quarter of 2023.

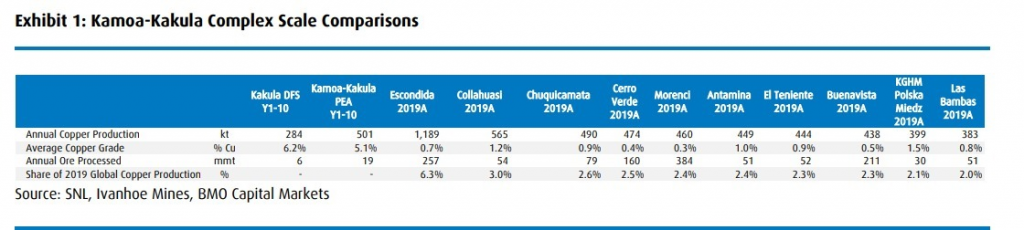

The Kamoa-Kakula 19 million tonnes per annum expansion, which delivers 501,000 tonnes of copper annually in the first ten years, puts Ivanhoe’s Kamoa-Kakula complex among the largest producers in 2019, says Mikitchook.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.