St. Louis Fed President James Bullard has taken another swipe at the central bank’s lethargic approach to taming out-of-control inflation, suggesting that it may soon lose its credibility if interest rates don’t increase quickly.

Bullard appeared on CNBC on Monday to express his concerns about accelerating price pressures, and to make his case for a rapid interest rate hike. “I do think we need to front-load more of our planned removal of accommodation than we would have previously,” Bullard told CNBC’s Steve Liesman. “Our credibility is on the line here and we do have to react to the data.”

Bullard’s comments come one week after the Fed president sent markets into a tailspin, when he suggested the central bank needs to hike short-term borrowing costs by at least one full percentage point before the end of July. The remarks, which were made during a Bloomberg interview, unleashed substantial volatility across stocks, with futures markets pricing in seven quarter-point increases before the end of the year.

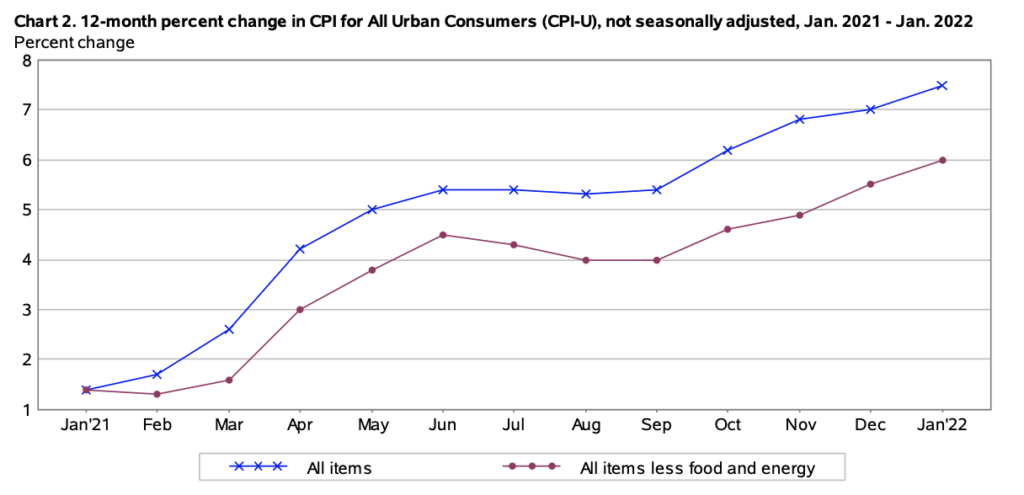

While the consensus among FOMC members favours an interest rate increase in March, Bullard’s stance has been the most hawkish in response to inflation consecutively surpassing the central bank’s 2% target rate. “My interpretation was not so much that report alone, but the last four reports taken in tandem have indicated that inflation is broadening and possibly accelerating in the U.S. economy,” he said, citing the latest CPI print, which showed consumer prices increased by a whooping 7.5% in January— the most since 1982.

In the meantime, markets are awaiting the release of January’s FOMC minutes, which are expected to show a clearer picture of the central bank’s plans to begin scaling back its balance sheet. The Fed currently has about $9 trillion worth of Treasurys and mortgage-backed securities, with plans to buy another $20 billion and $28 billion more, respectively, before the end of next month. Bullard said he wants to see a reduction in asset purchases come the second quarter, alongside a plan to actually sell the holdings instead of allowing the funds to run off passively.

Fed's Bullard says:

— Hedgeye (@Hedgeye) February 14, 2022

1) the Fed's credibility is on the line

2) Rate hike timing is Powell's responsibility

in other words, if we screw this up, it's Powell's fault.

Information for this briefing was found via CNBC and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.