The Federal Reserve once again delivered the fourth consecutive 75 basis-point rate hike on Wednesday, cementing one of the sharpest tightening cycles since 1981.

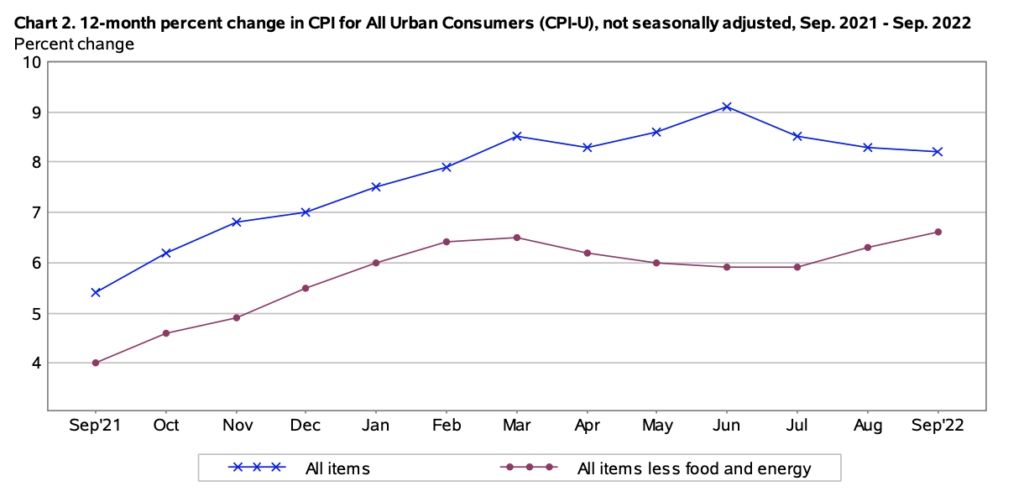

In its fight to bring inflation down to the 2% target range, FOMC members unanimously agreed to increase the federal funds rate to 3.75% and 4%, whilst agreeing that “ongoing increases” will be necessary to alleviate some of the highest price pressures in over 40 years. However, the Fed hinted that a dovish stance could be in the works, particularly as the Committee takes into account “the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments” in determining the future pace of hikes.

The Fed acknowledged that job gains across the US has been robust, and that the unemployment rate continues to remain low. Members also once again blamed Russia’s war in Ukraine for causing additional upward pressure on prices and weighing down global economic activity. However, economists are warning that the US economy could be headed towards a deep downturn if the Fed persists with its fight against inflation. Even Fed Chair Jerome Powell conceded that the central bank’s tightening could ultimately cause a recession. “No one knows whether this process will lead to a recession or if so, how significant that recession would be,” he said following the September FOMC meeting.

Information for this briefing was found via the Federal Reserve. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.