Jerome Powell, the US Federal Reserve Chairman recently addressed the current coronavirus-induced economic downturn via a webcast event for the Peterson Institute for International Economics, stating that a lot more still needs to be done to put the country back on track.

In his statement on Wedneday, Powell suggested the drastic downfall of the US economy is most likely far from over, and that there is a lot more work to be done to keep the current recession from spiraling out of control. He acknowledged that the Fed’s near-zero interest rates and various liquidity and lending programs are helping a lot, in addition to the stimulus funding provided by congress, but the path to economic recovery is still looking grim and riddled with risks. He clarified that the Fed’s hands are becoming increasingly tied as negative interest rates are out of the question, so instead he is urging Congress to take the reigns to keep the economy from further collapse.

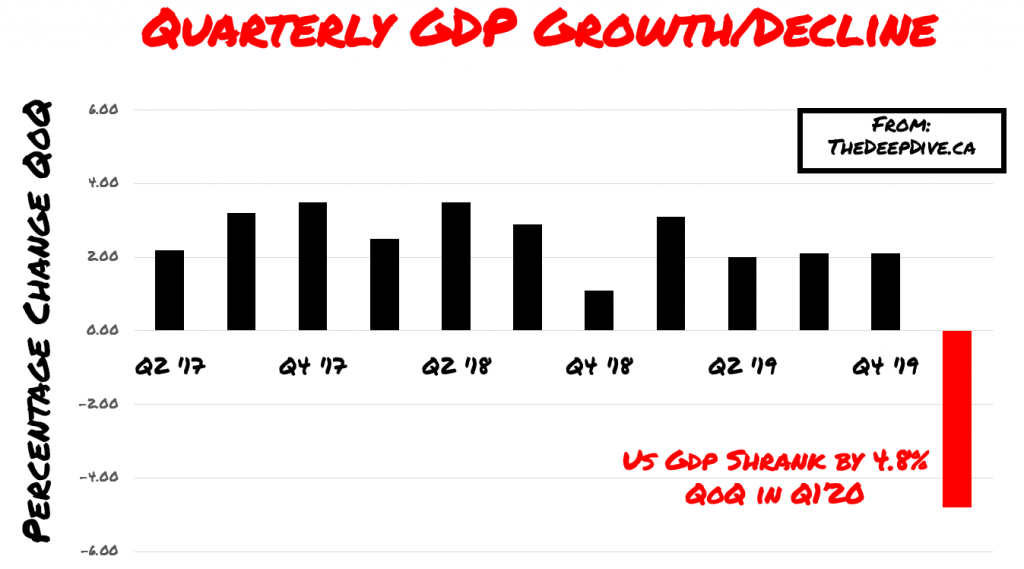

As a result of coronavirus lockdowns and soaring infection rates, the US economy has fallen into a slump not seen since the Great Depression of the 1930’s. The current unemployment rate is up to 14.7%, and all the previous decade’s job gains have been erased. Meanwhile, first quarter GDP levels shrank by 4.8%, with second quarter levels predicted to be even more grim.

Although the Fed has issued drastically low interest rates and Congress has passed almost $3 trillion worth of rescue funding as a means of mitigating the economic downturn, Powell said there is still a lot more work that needs to be done on the policy-maker side. Recently, House Democrats unveiled a second $3 trillion funding bill which is set for a vote on Friday, that includes a second round of the one-time $1,200 stimulus checks as well as more loans and tax breaks for “small businesses.” However, there is most likely going to be significant opposition from the Republicans – as always.

Information for this briefing was found via CNBC, Yahoo Finance, and Peterson Institute for International Economics. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.