With President Joe Biden left empty-handed after begging OPEC for more oil and midterm elections approaching fast, the White House is left scrambling to bring fuel prices down, or at least make it appear it is attempting to do so.

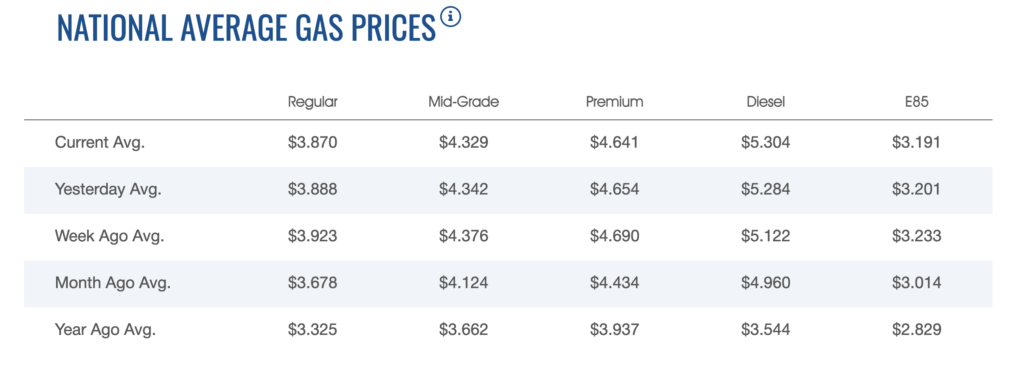

With average gasoline prices sitting at around $3.87 per gallon on Monday and midterm elections scheduled for November 8, Biden has entered panic mode and is expected to start selling oil from the Strategic Petroleum Reserve, mulling releasing the 14 million barrels left remaining of the unprecedented 180 million barrel sale that began in May.

In addition, the White House also held discussions with oil companies to prompt them to sell an additional 26 million barrels as part of a congressionally mandated sale come fiscal year 2023 which started on October 1, a source familiar with internal discussions said, as cited by Reuters.The Department of Energy is expected to provide further insight into eventually buying the oil back through to 2025 to replenish the soon-to-be-depleted SPRs. Back in May, the DOE announced it would open up bids to repurchase approximately one-third of the 180 million barrel sale, hinting that deliveries would be related to lower oil prices and slow demand.

The Biden administration has also reportedly been urging oil refiners such as Exxon Mobil and Chevron to halt exports and instead retain the oil for building inventories. In fact, Biden is supposedly even considering imposing a ban on gasoline and diesel exports— a move that would likely worsen the ongoing energy crisis in Europe.

Information for this briefing was found via Reuters and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.