US President Joe Biden unveiled his fiscal 2023 budget on Monday that aims to tackle the US$1.3 trillion deficit. But the highlight of the announcement was the plan to impose a “wealth tax” on the top 1%–considered to be the first-ever direct tax on billionaires.

This year, my Administration is on track to cut the deficit by more than $1.3 trillion.

— President Biden (@POTUS) March 28, 2022

$1.3 trillion — that would be the largest one-year reduction in the deficit in U.S. history.

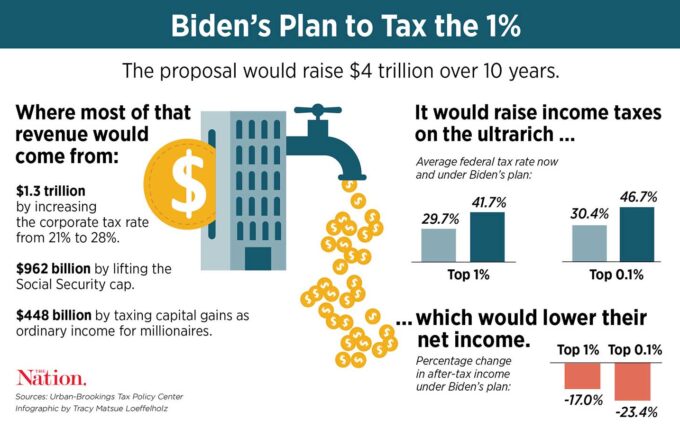

In discussing the federal budget he plans to submit to Congress for approval, Biden revealed the plan to enforce a “Billionaire Minimum Income Tax”. This aims to implement a 20% minimum income tax on American households earning more than US$100 million.

Taxpayers within the concerned income bracket with an effective tax rate greater than 20% will not be paying new taxes based on this proposal. But those paying below would pay the difference between their current tax rate and the new 20 percent rate.

On top of this, unrealized gains on assets will now also be taxed. These means that gains from stocks, bonds, or assets appreciating in value will now be part of taxable income. Currently, these gains are non-taxable until the asset is sold.

My budget also ensures that corporations pay their fair share.

— President Biden (@POTUS) March 28, 2022

In 2020, 55 of the most profitable corporations paid zero dollars in federal income taxes on $40 billion in profit.

My budget raises the corporate tax rate to 28%.

“We can restore fiscal responsibility by rolling back the Trump Tax cuts,” said Biden. “Under my plan, no one making less than $400,000 will pay an additional penny in taxes. But the wealthy and corporations will finally pay their fair share.”

Many feel this is a shift from his campaign stance of moderate policies, avoiding the discussion on wealth taxes. He has favored proposals for increasing the top marginal income tax rate, imposing a higher tax on capital gains and estates, and raising taxes on corporations instead of considering one’s wealth–not just income–as taxable.

Early criticisms of the proposed tax measure revolve much on taxing the unrealized gains, with many arguing that it is not yet considered income if not yet sold, and the timeliness of the tax imposed as gains can easily become losses the next tax period based on external factors.

“The White House proposal would enormously complicate the tax code and create huge investment distortions. “Illiquid” taxpayers—defined as those whose tradeable assets make up less than 20% of their wealth—could defer payments until their sale and incur an interest charge. Investors would thus have an incentive to pile into illiquid assets such as real estate to avoid regularly liquidating stock to pay taxes. Rather than sell stock to invest in other ventures, investors might have to sell stock they’d prefer to hold in order to pay taxes on unrealized capital gains,” explained in a Wall Street Journal editorial.

The proposed tax measure received mixed reactions from both sides of the aisle. Democrat Senator Joe Manchin III rejected the idea, saying Biden “can’t tax something that’s not earned.” Early arguments on the constitutionality of taxing on wealth rather than income has also surfaced.

Biden’s new plan: Tax the top 0.01% to lower the deficit by $1 trillion and fund clean energy independence.

— No Lie with Brian Tyler Cohen (@NoLieWithBTC) March 28, 2022

GOP plan, per NRSC Chair Rick Scott: Raise taxes on households earning less than $50,000 by an ADDITIONAL $4,500 after CUTTING taxes for the rich.

Vote accordingly.

Spot the difference:

— Chuck Schumer (@SenSchumer) March 28, 2022

President Joe Biden’s budget makes sure billionaires pay their fair share.

Senator Rick Scott’s platform for the Republican Party raises taxes on seniors and working families.

For too long, billionaires have avoided paying their fair share in taxes.

— Adam Schiff (@RepAdamSchiff) March 28, 2022

President Biden's billionaire minimum income tax would help fix that.

And go a long way toward making our economy work for everyone.

It's about time everyone paid their fair share, don't you think?

Jeff Bezos paid $0 in federal income tax in 2007 and 2011. Elon Musk paid $0 in 2018. The Forbes 400's average tax rate is 8%.@POTUS is 100% right to propose a 20% minimum #BillionairesTax to make them start to pay their fair share.https://t.co/mVVBN0bI8O

— Americans For Tax Fairness (@4TaxFairness) March 29, 2022

President Biden’s $5.8 trillion budget includes the largest tax incease in history.

— Rep. Jim Jordan (@Jim_Jordan) March 29, 2022

Just what America needs with record inflation and $4 gas!

Even Bernie Sanders would blush reading the budget Biden proposed.

— Lauren Boebert (@laurenboebert) March 29, 2022

An unrealized gains tax?

That is legalized theft.

Today Joe Biden will unveil a tax increase in his 2023 budget.

— Lance Gooden (@Lancegooden) March 28, 2022

Why are we hiking taxes if Biden's agenda costs zero dollars?

The federal budget, along with the proposed billionaires’ tax, will still be up for approval in the Congress.

Information for this briefing was found via New York Times. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.