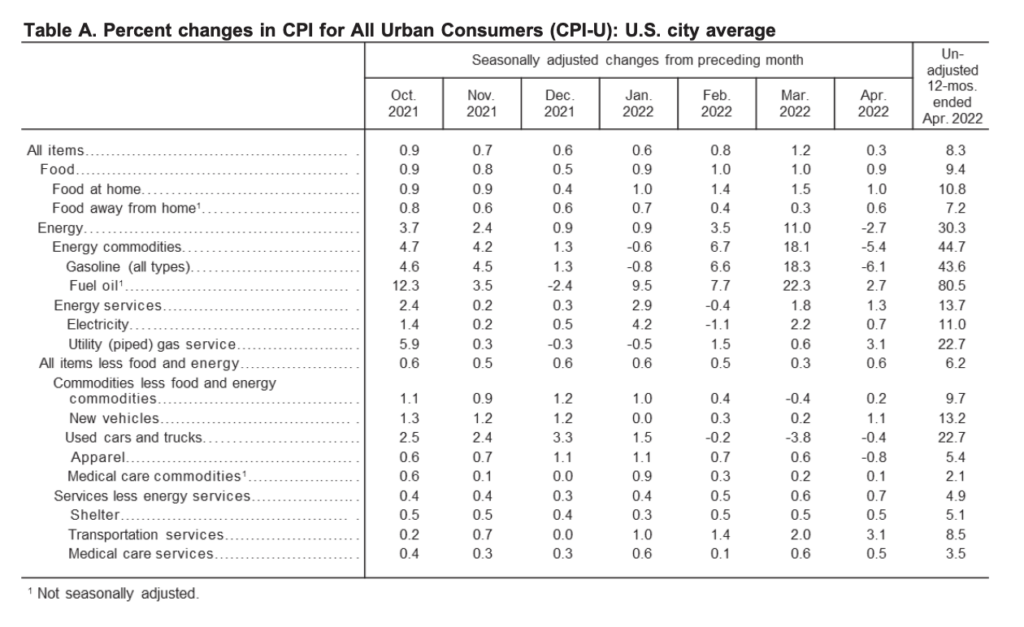

With inflation persistently soaring to the highest in decades and the Putin blame-game failing to make a foothold with the American public, US President Joe Biden is scheduling an unusual Oval office meeting with Fed Chair Jerome Powell in a desperate attempt to devise a plan on fighting eye-watering price pressures and a stagnating economy.

According to a statement from the White House, Biden is expected to hold discussions with Powell regarding the state of the US and global economy, while assuring the American public that he will not meddle with the Fed’s monetary policy. Following the talks, Biden’s itinerary for the remainder of the afternoon will be comprised of a meeting with K-pop group BTS to “discuss the importance of diversity and inclusion.”

Indeed, inflation is becoming very unpopular with Americans, who are witnessing their cost of living skyrocket and wage growth stagnate, despite assurances from the Biden administration of a robust economy and strong markets. In a hail Mary attempt to save the Democrats from major losses in the upcoming midterm congressional elections, Biden is promising to tackle colossal inflation by letting the Fed increase borrowing costs as needed, boost “productive capacity” to reduce the cost of living for households, and cut budget deficits.

Sounds like a fantastic plan, right? Sure, except that it remains unknown how, exactly the Biden administration will bring his proposed goalposts to fruition. Powell, or as per Sen. Elizabeth Warren— the “dangerous man”, will either have to continue raising rates rapidly and sharply should the Fed one day bring inflation to the 2% target rate, or travel back in time to tear up the transitory narrative and start hiking rates like everyone else and their dog suggested at the time.

We aren’t sure what the president means by boosting “productive capacity” either— would that involve restoring supply chains? adjusting industrial policies? loosening capital controls? Certainly reducing budget deficits would also be a good way to slow inflation, but such a move would likely not gain popularity during the mid-term elections, especially since it would run counterproductive to the Biden administration’s “Build Back Better” plan. We’re throwing in the towel on dissecting this one, but one thing is for sure: whatever Biden and the Fed are currently doing isn’t working…

Information for this briefing was found via the White House and the BLS. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.