Last month’s FOMC minutes revealed that the Fed continues to perceive inflation as “unacceptably high,” and that price pressures are broad-based throughout the economy. However, members also voiced concerns about enacting too much hawkish monetary policy too early, given that the bulk of the central bank’s tightening effect has yet to be felt.

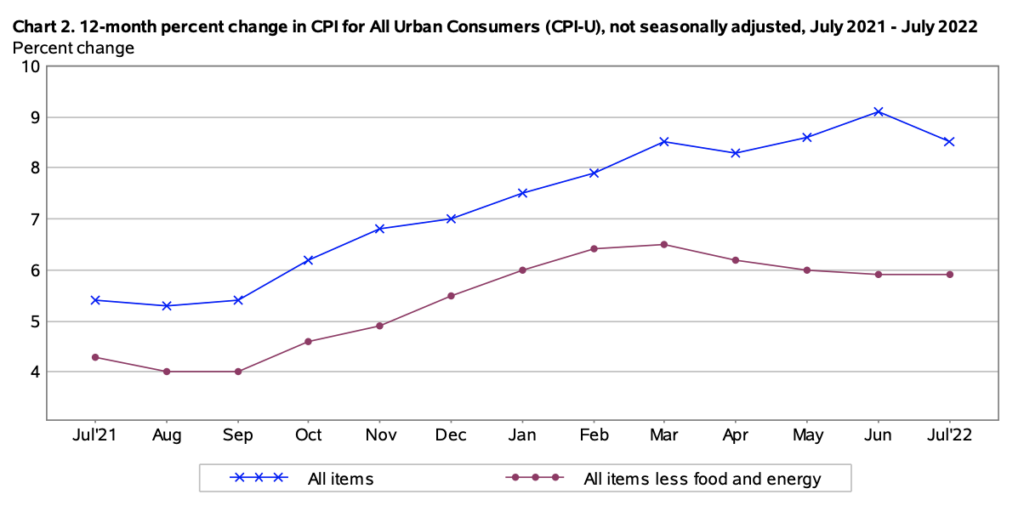

July’s sentiment suggested the pivot towards a more dovish monetary policy may be en-route, so as long as inflation figures don’t continue to explode substantially higher. Latest data from the BLS showed consumer prices decelerated from 9.1% to 8.5% in July, largely due to a drop in the cost of gasoline. As such, members felt there was a risk of over-tightening given the constant shifts in the economic environment, and are expecting the pace of rate hikes to slow at some point.

“As the stance of monetary policy tightened further, it likely would become appropriate at some point to slow the pace of policy rate increases while assessing the effects of cumulative policy adjustments on economic activity and inflation,” read the minutes from the FOMC’s July 26-27 meeting. “Many participants remarked that, in view of the constantly changing nature of the economic environment and the existence of long and variable lags in monetary policy’s effect on the economy, there was also a risk that the committee could tighten the stance of policy by more than necessary to restore price stability.”

During the last FOMC meeting in July, Fed officials raised the benchmark rate by 75 basis points for a second consecutive month, marking the sharpest pace of tightening since the 1980s. Labour Department data released earlier in August showed that payrolls increased by 528,000 last month— almost double that of consensus estimates, prompting investors to pencil in another 75 basis-point increase in borrowing costs. However, the Fed’s language at the time implies that the second half of the tightening cycle could be substantially less aggressive.

⚠️ We're at halftime in the Fed hiking cycle. And the Fed think the second half will be a lot less aggressive. Good for beaten-down risk sentiment. If the Fed hikes for longer… very possible… it'll be because of strength in US economy. Rates & equities grind higher? $USD #SPX pic.twitter.com/6qhg5MKqZF

— Viraj Patel (@VPatelFX) August 17, 2022

“While the FOMC minutes continue to emphasize the need to contain inflation, there is also an emerging concern the Fed could tighten more than necessary,” said FHN Financial chief economist Christopher Low, as cited by Bloomberg. “There is an inkling of improvement on the supply side of the economy, there is a bit of hope in some product prices moderating, but there is still a great deal of concern about inflation and inflation expectations.”

Information for this briefing was found via the Federal Reserve and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.