Earlier this week, Jushi Holdings Inc. (CSE: JUSH) finally reported their first quarter 2021 and full year 2020 results after long delays by their auditor MNP. Jushi announced that their 2020 revenues increased 690% to $80.8 million year over year and gross profit came in at $43.1 million, with an adjusted EBITDA margin of ($3) million.

For the first quarter of 2021 the company had total revenues of $41.7 million, a 29% sequential rise, while the company had a gross profit of $20.1 million, and adjusted EBITDA of ($3) million.

Jushi only has six analysts who cover the name with a weighted 12-month price target of C$12.77, or a 78.33% upside. Three analysts have strong buy ratings and the other three have buy ratings. The street high sits at C$14 from two different analysts while the lowest is C$11.50.

In Canaccord’s update note for Jushi, their analyst Bobby Burleson reiterates his U$10.00 (~C$12.61) price target and speculative buy rating. He says that both sets of numbers generally came in line with the pre-announced expectations but it shows that Jushi is, “delivering strong top-line while investing for further growth.”

The company also gave second-quarter guidance which came slightly below Canaccord’s previous estimates, calling the guidance “a little soft.” They however still have reiterated their rating and price target. Bobby also says that “guidance for 2021 is intact for now,” but wouldn’t be surprised if adjusted EBITDA came in slightly below the low end of the guidance.

The companies operations seem to be improving with Burleson writing, “JUSHF has improved its operational footprint and competitive position in its core markets of PA and IL.” In Jushi’s other states, Burleson points out that Virginia looks primed for “dramatic growth” and remains the company’s key differentiator. He also believes that the companies M&A pipeline remains robust as the company has recently announced multiple acquisitions to help plant flags in different states.

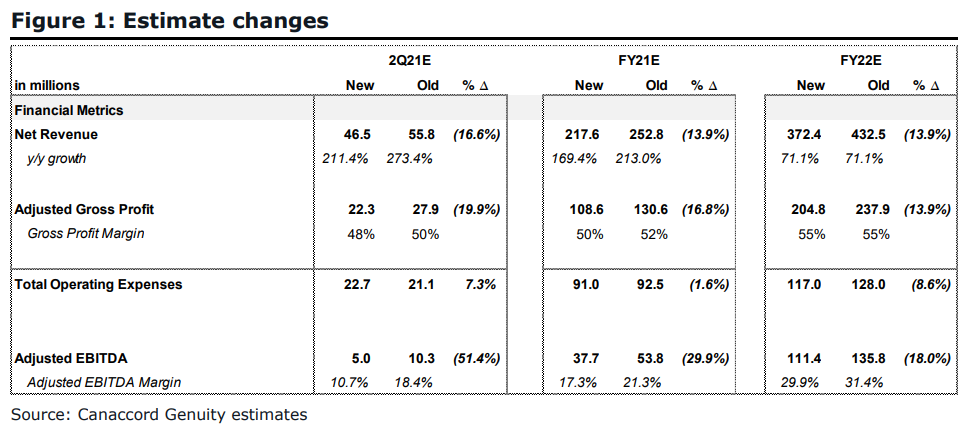

Below you can see Canaccord’s updated 2021 and 2022 estimates based on management guidance.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.