Yesterday, Canopy Growth Corp (TSX: WEED) (NASDAQ: CGC) reported their third fiscal quarter results. They recorded net revenues of $152.5 million and a net loss of $829.3 million. The company managed to grow cannabis revenues 9% year over year, while other revenue grew by 61% and total revenue grew by 23%.

Canopy currently has 17 analysts covering the company with a weighted 12-month price target of C$42.89. This is up from the average before the results, which was C$28.27. One analyst has a strong buy rating. Two analysts have by ratings. Eleven analysts have hold ratings, one analyst has a sell rating, and two analysts have strong sell ratings on Canopy.

Here’s a summary of Canopy’s recent analyst changes:

- Stifel raises target price to C$21 from C$18

- Benchmark cuts to hold from buy

- MKM Partners raises fair value to C$55 from C$28

- Cowen and Company raises target price to C$75 from C$38

- CIBC raises price target to C$64 from C$32

- Alliance Global Partners raises target price to C$60 from C$41

- Cormark Securities cuts to reduce from market perform

In a rare circumstance, Canaccord’s analyst Matt Bottomley downgraded Canopy and raised his 12-month price target. Bottomley downgraded Canopy to a hold from a buy rating while his price target increased to C$32 from C$25 and headlined, “In-line quarter while valuation runs above fundamental support.”

He notes the recent and ongoing run in cannabis is due to macro headlines coming out of the U.S. and says it, “has resulted in a disproportionate amount of capital to flow into a number of leading Cdn L.P.s (perhaps due to their U.S. listings where many U.S. domiciled operators are still not permitted to trade).”

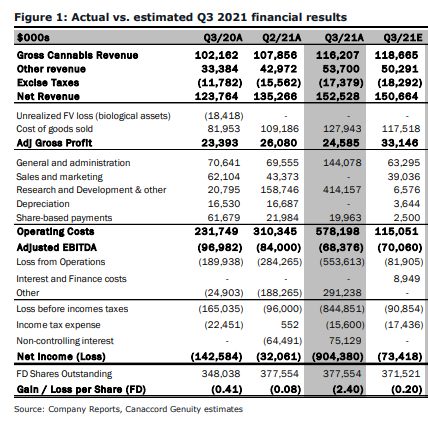

Canopy’s C$152.2 million total net revenue was slightly ahead of Canaccord’s C$150.7 million. The core driver of the companies growth was the other segment, which includes Storz & Bickel vaporizers, BioSteel products, and ThisWorks health and wellness products.

Gross margin came in at 16%, down 3% from the last quarter, below Canaccord’s 22% estimate. This is primarily due to restructuring charges booked during this quarter. Bottomley calls Canopy’s -C$68.4 million EBITDA loss “lofty” and says that the annualized free cash flow burn is now at C$540 million.

Below you can see Canaccord’s third-quarter estimates vs. actual results.

Bottomley says the reasoning for the downgrade and raised price target is primarily due to “the implied negative return vs. current CGC levels,” and Canopy’s C$23.5 billion market cap, “represents ~31x NTM net revenue and 2.4x our peak revenue forecasts for the Cdn industry as a whole.”

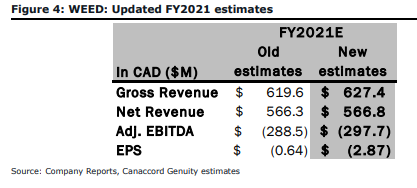

Below you can see Canaccord’s updated the fiscal year 2021 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.