On January 31st, Canaccord Genuity Capital Markets initiated coverage on K92 Mining Inc. (TSX: KNT), with an C$8.75 12-month price target and speculative buy rating. This is the 13th analyst to cover K92 Mining. The average 12-month price target is C$11.38, or a 75% upside to the current stock price. Out of the 13 analysts, 4 have strong buy ratings and the other 9 have buy ratings. Two analysts have a C$13 12-month price target, which represents a 100% upside to the stock price.

Canaccord says that the company is a single asset gold mine, whom operates in Papua New Guinea at their Kainantu Mine, which provides a “compelling FCF story” as the company continues to grow the asset. Canaccord calls the current asset, “a high-grade, long-life, underground epithermal vein system that we see as best-in-class.”

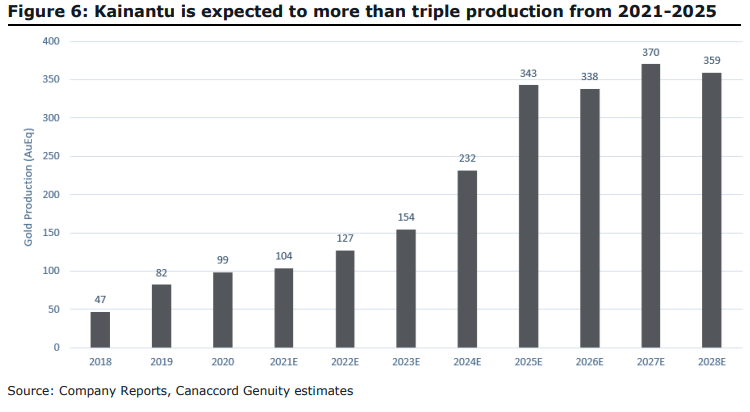

Canaccord praises K92’s management for being “astute operators” after buying Kainantu from Barrick in 2015 and providing a breakthrough discovery in 2017. They expect that K92 will continue to build on its organic growth plan, with Canaccord expecting a number of expansions to bring a new 1Mtpa+ mill by 2024. They expect this mill to more than triple their production to 340,000 gold equivalent ounces by 2025.

Canaccord adds that the Kora deposit continues to help provide growth, saying that the management has transformed it “from a distinct set of geologically misunderstood deposits into one of the most impressive gold discoveries globally.” They expect that additional exploration will continue to unlock shareholder value and expect an updated PEA and resource estimate during the first half of 2022. Although K92 has no reserves as they have not conducted a feasibility study to support the economics of the resource, Canaccord expects that since the operations have historically shown strong economics, it is likely a “substantial” amount of the resource will be converted to reserves.

Lastly, Canaccord says that the company has a strong operational-focused management team with the current CEO, John Lewis, boasting decades of mining experience worldwide. Lewis also held positions at MIM Holdings, First Dynasty Mines, Platinum Australia, and African Thunder Platinum. While the senior vice president, Warren Uyen, is another mining engineer who has over 30 years of experience. The vice president of exploration, Chris Muller, is a geologist with over 20 years of experience.

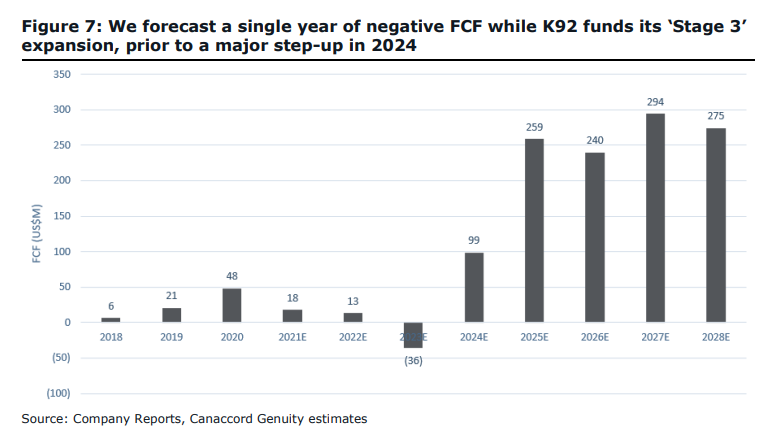

For the 2022 outlook, Canaccord expects production of 127,000 gold equivalent ounces at a cash cost of US$595 per ounce and an all-in sustaining cost of $930 per ounce. They expect the company to report US$13 million in free cash flow for the full year 2022.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.