K92 Mining Inc. (TSX: KNT) announced a $50 million bought deal this past week, selling 5,405,000 common shares at a price of $9.25 per share. The deal has an over-allotment option for underwriters to purchase an additional 810,825 shares for an additional $7.5 million. K92 said that they intend to use the proceeds for the “continued expansion of the Kainantu Gold Mine, exploration near-mine and regionally,” as well as for general working capital purposes.

K93 currently has 9 analysts covering the stock with an average 12-month price target of C$12.28, or an upside of roughly 40%. Out of the 9 analysts covering the stock, 4 of them have strong buy ratings while the other 5 have buy ratings. The street high sits at C$14 from 2 analysts and represents an upside of 60%.

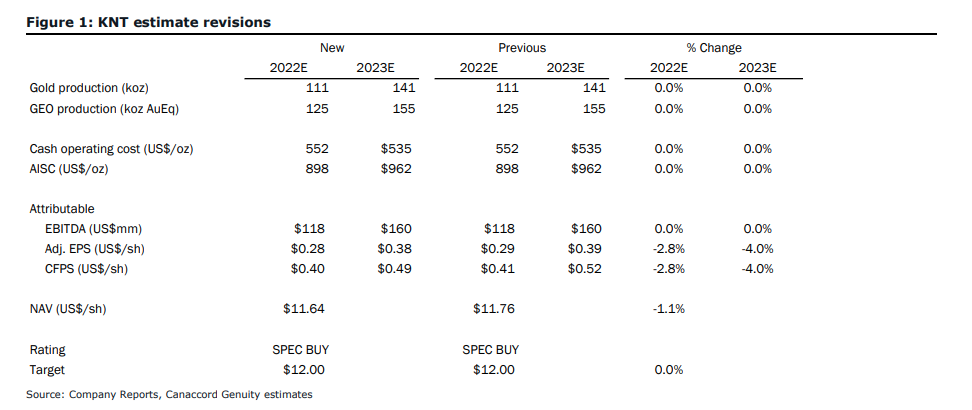

In Canaccord’s note on the news release, they reiterate their speculative buy rating and C$12 12-month price target, saying that the bought deal helps de-risk the company’s planned expansion. The company is expected to commission its Stage 2A mill which would bring its throughput from 400ktpa to 500ktpa. This expansion is expected to cost roughly US$2.5 million and is expected to start commissioning later this year.

Canaccord is currently modeling that K92 will need initial capital of US$225 million and total capital of US$363 million from 2023 to 2024 to support their build-outs. This is above the company’s own estimates within its PEA of US$125 million of growth capital and US$240 million of total capital.

The company is also contemplating a US$100 million corporate facility, “that should provide additional flexibility and allow the company to continue its aggressive exploration program during the “Stage 3″ build.”

Canaccord now believes that the company has a “sizeable cash cushion” for all its upcoming expansions. More specifically, they believe that this will also allow the company to continue its exploration program even if gold drops to $1,500 an ounce. Though they do note that this cash comes with dilution, saying that this sort of funding “highlights the potential issue created by the current inflationary environment.”

Below you can see Canaccord’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.