On October 6th, K92 Mining Inc. (TSX: KNT) reported it’s third-quarter production results. The company said that it produced 32,995 gold equivalent ounces, which is the company’s second-highest production results on record. The firm produced 29,256 ounces of gold, 1,666,076 pounds of copper, and 32,161 ounces of silver. The company said for the quarter it sold 25,297 ounces of gold, 1,551,981 pounds of copper, and 28,396 ounces of silver.

K92 Mining also recorded a record plant throughput of 117,939 tonnes processed or 1,282 tonnes per day, up 35% year over year. They note that the head grade during the quarter was 8.67 g/t gold, 0.72% copper, and 11.53 g/t silver. They also hit another production record, with 122,035 tonnes of ore mined or 1,326 tonnes per day.

Lastly, K92 Mining said that twin incline development made “significant progress” in advancing the project 33% above their budget during the quarter and 36% above budget year to date.

K92 Mining currently has 14 analysts covering the stock with an average 12-month price target of C$11.29, or an upside of 46%. Out of the 14 analysts, four have strong buy ratings, nine analysts have buy ratings, and a single analyst has a hold rating. The street-high price target sits at C$13, representing an upside of 69%.

In BMO Capital Markets’ note on the results, they reiterate their outperform rating and $11 long-term price target, representing an upside of 33%. They say that the specific throughput was impressive.

On the production results, K92 Mining’s total production of 32,995 ounces beat the street consensus but missed BMO’s 36,000-ounce estimate. The miss was based on BMO expecting higher gold grades of 11.77 g/t versus the actual 8.67 g/t. As a result, BMO has adjusted its expectations to be more in line with the actual results under the Stage 2A expansion.

Though BMO says that mill throughput of 117,938 tonnes beat their estimate of 95,000 tonnes, as they say, the “process plant continued its strong performance and growing throughput capacity ahead of the Stage 2A expansion.” Specifically, BMO points to August’s throughput, which averages 1,373 tonnes per day, which they view as a “promising sign of further strong performance.”

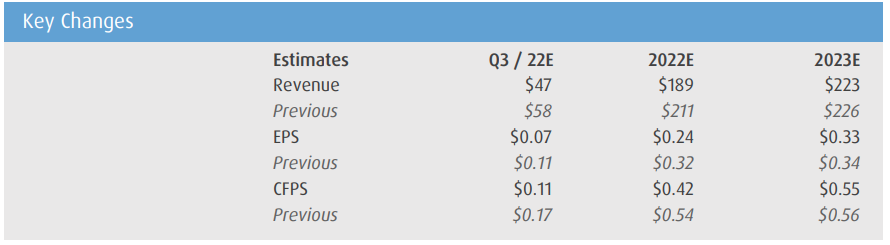

Below you can see BMO’s updated estimates.

Information for this briefing was found via Edgar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.