Earlier this week, K92 Mining Inc. (TSX: KNT) reported its second quarter financial results. The company announced that it produced 26,085 ounces of gold equivalent ounces, or 22,934 ounces of gold, 1,229,961 lbs of copper, and 25,224 ounces of silver. The quarter reportedly saw record plant and mine throughput of 108,853 tonnes and 114,471 tonnes, respectively, which equates to 1,196 tonnes per day and 1,258 tonnes per day for the throughput of the plant and mine, respectively.

K92 saw its cash and all-in sustaining costs decrease to US$617 and US$893, respectively. The average realized selling price per ounce increased slightly to US$1,783, with the company selling 23,674 gold ounces this quarter.

K92 Mining currently has 13 analysts covering the stock with an average 12-month price target of C$11.38, or an upside of 37%. Four of the 13 analysts have strong buy ratings, while the other nine have buy ratings on the stock. The street high price target sits at C$13, representing an upside of 57%.

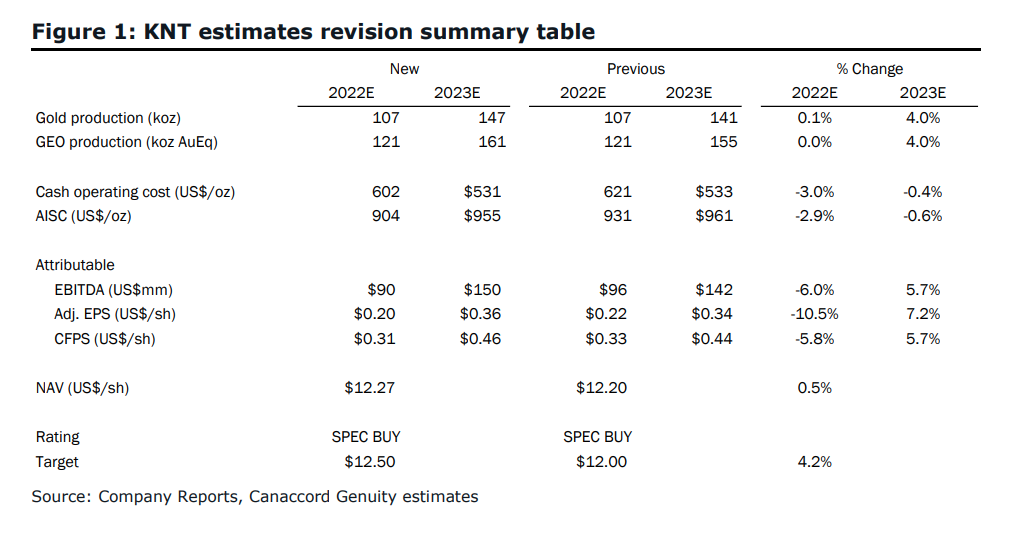

In Canaccord Genuity Capital Markets’ note on the results, they reiterate their speculative buy rating on the stock while raising their 12-month price target to C$12.50 from C$12.00, saying that the results were bolstered by strong “Stage 2” expansion throughout and believe investors “should remain focused on the upcoming “Stage 3″ Feasibility Study/updated-PEA for KNT.”

Canaccord says that K92 is on track for a “solid operational year” as mill throughput was the highest it’s ever been, which helps set up K92 to hit and/or beat the 400ktpa budget for “Stage 2.” They expect this throughput rate to continue in the third and fourth quarters all while seeing higher grades.

They also expect sustaining costs to rise during the second half of the year, primarily due to a ramp-up in the company’s underground development spend.

They add that they believe the main focus of K92’s story is the maiden FS/PEA update at Kainantu, which is expected to be released during the third quarter of 2022. They expect that the update will “outline K92’s potential transition to an intermediate producer.” Canaccord believes it will showcase that K92 will produce 350,000 gold equivalent ounces versus the 104,000 ounces produced in 2021.

Lastly, Canaccord says that K92 has a strong and healthy balance sheet heading into the year’s second half. They expect that K92 will end the year with US$127 million in net cash, leaving “the company comfortably positioned heading into the “Stage 3″ build next year.” Though Canaccord believes that the 2020 PEA for “Stage 3” of US$125 million is low and is expecting a “material initial CapEx increase.”

They assume that the total sustaining and initial CapEx for Kainantu will be US$365 million in 2023 and 2024; they expect the company to finance the portion of this with internal free cash flow and debt.

Below you can see Canaccord’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.