Celebrity Kim Kardashian has agreed to settle with the Securities and Exchange Commission a case involving her unlawfully touting a crypto asset on social media without disclosing she was paid to promote such. Without admission, the American socialite paid US$1.26 million to the regulatory body.

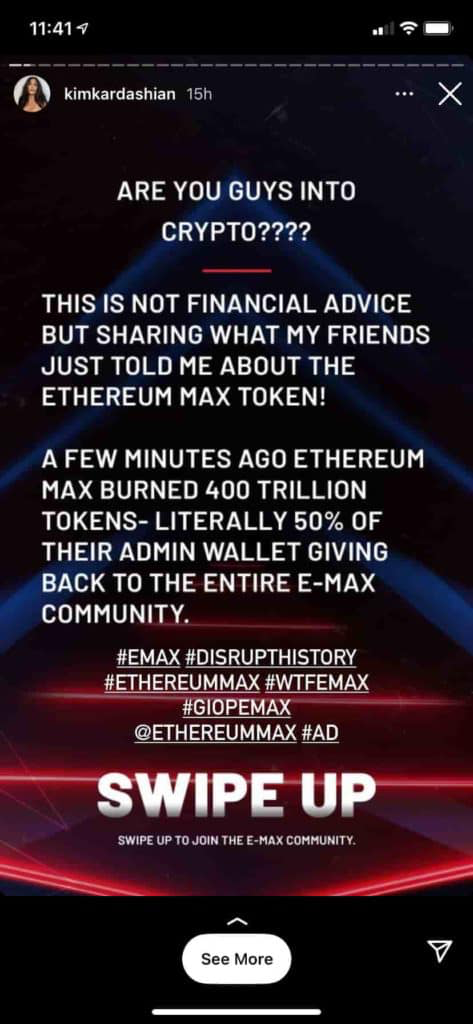

The anti-touting violation that Kardashian allegedly committed relates to her social media post promoting EMAX tokens, the crypto asset security being offered by EthereumMax. She failed to disclosed that she was paid US$250,000 to post the promotion on her Instagram account, as federal security laws require any individual to inform such compensation in exchange for publicity.

“This case is a reminder that, when celebrities or influencers endorse investment opportunities, including crypto asset securities, it doesn’t mean that those investment products are right for all investors,” said SEC Chair Gary Gensler.

The agency’s Division of Enforcement added that “investors are entitled to know whether the publicity of a security is unbiased, and Ms. Kardashian failed to disclose this information.”

Kardashian, along with boxer Floyd Mayweather and basketball pro Paul Pierce, is being sued separately in the Central District of California, with the suit characterizing said promotion of the digital asset as misleading. The complainant alleges that the defendants made false claims to their fans and followers in an effort to persuade them to buy into the cryptocurrency platform, which the accused then exited with significant gains once the tokens rose in value.

As per the suit, EthereumMax jumped by more than 1,370% after Kardashian promoted the token to her Instagram followers. Shortly after, though, the token plummeted over 98%, without ever recovering.

The US$1.26 million settlement includes approximately US$260,000 in disgorgement, which represents her promotional payment, plus prejudgment interest, and a US$1.0 million penalty.

Kardashian also undertakes not to promote any crypto asset securities for three years.

Information for this briefing was found via SEC. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.