The latest issuer set to come to the Canadian Securities Exchange appears to be Kings Entertainment Group (CSE: JKPT). The online gaming firm has received conditional approved to list on the exchange.

King Entertainment currently has two main assets within the online gaming space, LottoKings and WinTrillions. Defined as its flagship, LottoKings describes itself as a “profitable online service prodiver for lottery, casino and sportsbook gambling.” The company also partners with firms in the casino space to offer gamines as well.

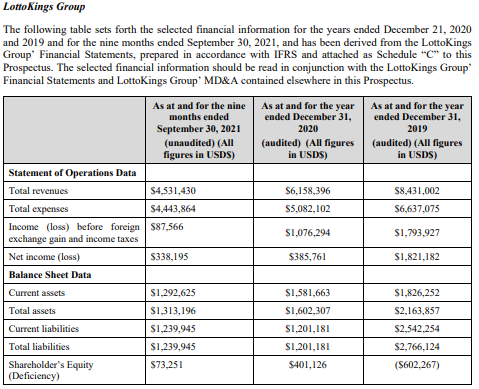

The company currently has the majority of its operations in the Latin American market, with the company indicating that it intends to push into North America and Europe. From a performance perspective however, its operations appear to be on the downswing. In 2019, the firm recorded total revenues of $8.4 million, which fell to $6.2 million in 2020. For 2021, the nine months ended September 30, 2021 saw revenues of $4.5 million, suggesting a second straight year of declining revenues might be in play.

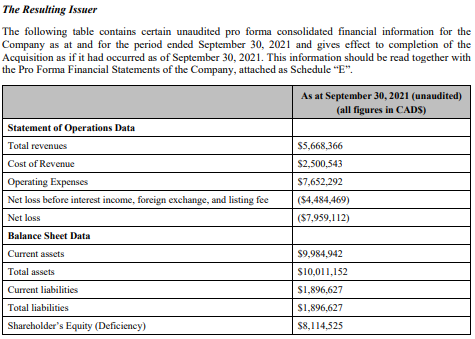

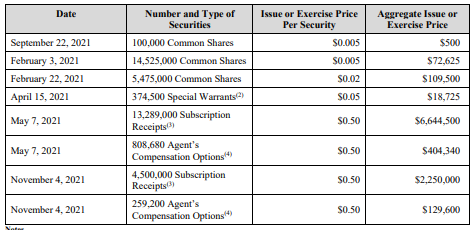

Despite its claims of profitability, as of September 30, 2021, the most recently available quarterly data, the resulting issuer following the merging of assets had a net loss of $8.0 million for 2021, with revenues of $5.7 million. At the end of that quarter, the firm had just US$0.2 million in available funds, before subscription receipt funds of C$8.9 million are added to the mix, which saw 17.8 million subscription receipts sold at $0.50 per each.

Upon the completion of its go-public transaction, the company is expected to have a total of 68.5 million shares outstanding. Of the shares outstanding, 14.8 million were issued at $0.005 per share, 5.5 million were sold at $0.02 per share, and 30.0 million were issued as payment shares for the purchase of LottoKings.

A final trading date for the company is expected to be announced in a subsequent announcement.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

The 8m ‘loss’ was just an accounting one related to a) the ~4 million related to the options granting which is normal/standard as management needs to be incentivized to build a great company and b) the costs related to the go public. Neither of these are operating related.

Moreover the fact 2020 was a down year is why they added the high profile CEO, and overhauled the archaic websites they had in 2020. So its not apples to apples with the current company. And they have not touched a cent of the 8.5m they raised as it was a sub receipt. So I would have to say that things will be looking up going forward for this company.