On June 28, Kinross Gold Corporation’s (TSX: K) management provided an updated presentation on their Great Bear project and other U.S based projects and hosted a Q&A session.

On the Great Bear project, Kinross’ management said that the company is “is making excellent progress and is on schedule to declare an initial mineral resource as part of its 2022 year-end results.” They add that they have drilled roughly 83,000 meters and are on track to drill 200,000 meters of exploration and infill drilling during the 2022 season.

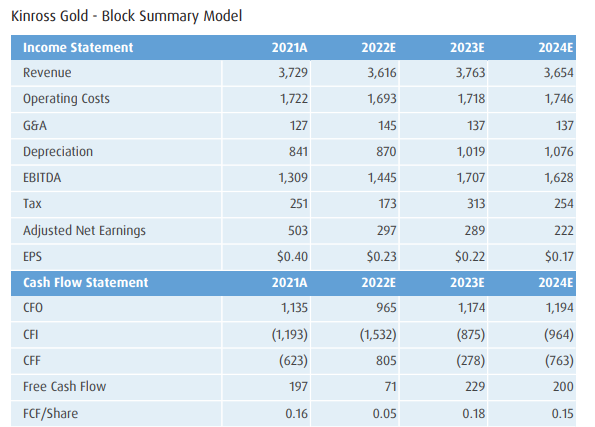

On Kinross’ Manh Choh project, Kinross now expects that the project will see production during the fourth quarter of 2024, with an average annual production between the years 2025 and 2027 of between 350,000 to 400,000 gold equivalent ounces. This production is estimated to have an all-in sustaining cost of between $1,100 and $1,200 a gold equivalent ounce.

Kinross Gold currently has 11 analysts covering the stock with an average 12-month price target of C$10, or an upside of 110%. Out of the 11 analysts, 2 have a strong buy rating, 6 have buy ratings, and the last 3 analysts have hold ratings on the stock. The street high sits at C$13, or an upside of 170%.

In BMO Capital Markets’ note on the news, they reiterate their outperform rating and raise their 12-month price target from C$7.00 to C$7.50, saying that they have updated their model reflecting management’s commentary during the Q&A and improvements at Great Bear.

After the Q&A session, BMO believes that Kinross will be able to hit the higher end of its designed milling capacity guidance. Kinross previously said that they expect the designed milling capacity for the project to be in the range of 10-15 ktpd. The size is viewed as being modest when compared to expected sizing of the open pit mine, its expected to be “well-balanced” for the future underground mine.

Another positive BMO walked away from the management Q&A with is that the company will stockpile lower-grade ore for processing at the end of the open-pit mine life. They are also now expecting a larger open pit operation at a slightly lower grade. They expect the open pit to do 20 ktpd versus 15 ktpd and at a grade of 3 g/t versus 3.5 g/t.

BMO has also increased its development costs due to “overall industry inflation as well as the higher cost of building stockpiles and the larger mining/milling capacity.” They now expect development costs of US$2 billion versus their previous estimate of US$1.5 billion. All in sustaining costs for the operation meanwhile are expected to remain in the US$600-800 per ounce range.

Below you can see BMO’s current estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.