On June 21st, Kinross Gold Corporation (TSX: K) announced an update on the Tasiast Mill fire. The company announced that mining activities and project work has been resumed and that there were no injuries. The company also reported that they do not anticipate the hiccup to “affect Tasiast’s life of mine production and mineral reserve estimates, or have a material impact on the mine’s overall value.” The stock quickly dropped down about 6%, but closed up the day down just 2.6%.

Many analysts lowered their price targets on the back of this news, bringing the company consensus 12-month price target down to C$13.47, or a 72% upside. Out of the 12 analysts, two analysts have strong buy ratings, eight have buy ratings and two have hold ratings. The street high sits at C$17.50 while the lowest comes in at $9.84 from Credit Suisse.

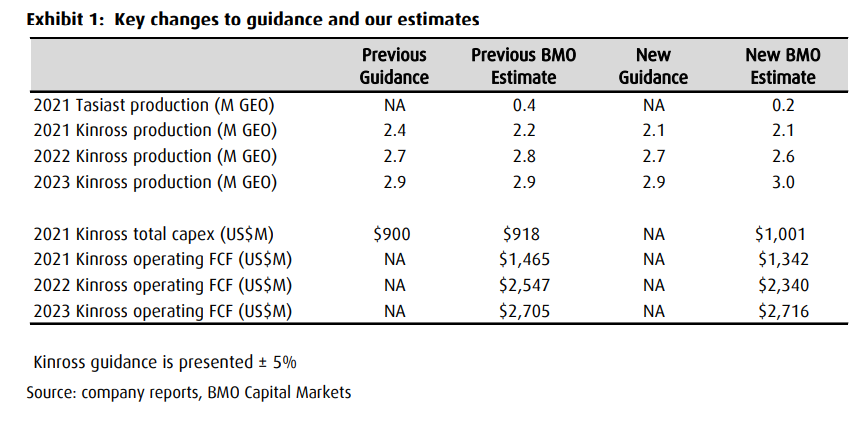

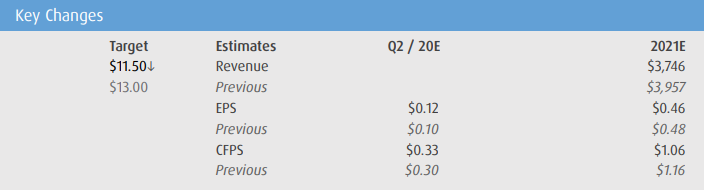

Within BMO’s note, the firm lowered their 12-month price target on Kinross to $11.50 from $1300, while reiterating their outperform rating. Jackie Przybylowski says that although the company has said this fire has not affected production, they elected to lower production at Tasiast for 2021 and 2022.

Przybylowski has lowered their second-quarter and full-year 2021 estimates off the back of this fire due to them not understanding the full impacts of the event. She writes, “we have made our best attempt at this time: we have lowered production in 2021 to 2.06M GEO.” They also lowered production guidance by just 0.1 million GEO per year going out to 2023.

BMO believes that the bulk of the recovery will happen in 2022, with Przybylowski taking the same stance that there is only a 10% chance that the motor and mill shell is damaged. She writes, “This increases the probability that repairs will be completed relatively quickly (within ~six months) and within the ~US$50M cost estimate.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.