On Wednesday, July 1, during market hours Kirkland Lake Gold (TSX: KL) reissued it’s 2020 guidance. The company had originally withdrawn guidance on April 2 as a result of COVID-19 and the unknown implications it would have on operations. Kirkland’s revised guidance is for 1.35 – 1.40 million ounces of gold to be produced at an all-in sustaining cost of $790 – $810/oz, 9% below their initial 2020 estimate of 1.47 – 1.54 million ounces, while all-in sustaining costs are down ~4% from original estimates of $820 – $840/oz.

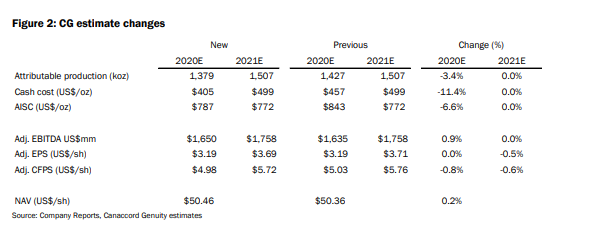

Canaccord Genuity sent out a note to its clients on Thursday, revising their estimates to reflect recent guidance changes but did not change their price target nor rating. The current price target is set at C$68.00, along with a Buy rating, which gives Kirkland gold a ~20% upside. Canaccord’s revised estimates are 1.38 million ounces with an all-in sustaining cost of $787/oz, down from previous estimates of 1.43 million ounces at an all-in sustaining cost of $843/oz.

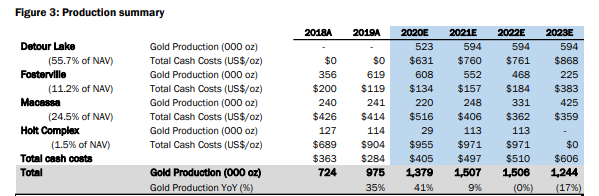

Canaccord mentions that the majority of the production decrease alongside the variance to their forecast came from the Holt complex where Kirkland has suspended operations. Holt was also removed from Kirkland’s 2020 guidance, while the lower all-in sustaining cost is more economical for the same reason. The Holt Complex has a high cost of production, with an all-in sustaining cost of $955/oz, significantly higher than Kirkland’s other operations.

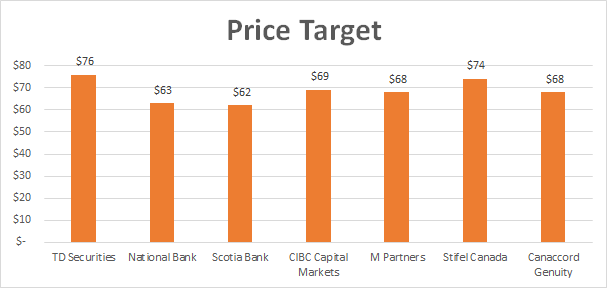

There are currently 12 analysts with price targets and ratings on Kirkland. The mean price target for Kirkland is C$67.00 and the weighted rating is a buy rating, which 7 out of the 12 analysts have given. The highest price estimate comes in at C$76.00, from TD Securities analyst Steven Green.

Information for this briefing was found via Sedar and Kirkland Lake Gold Ltd. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.