Kirkland Lake Gold (TSX: KL) recently announced 2021 operating guidance and their production profile visibility to 2023. Production for 2021 is currently pegged to be relatively similar guidance provided for 2020, with gold ounce production estimated to be within the 1.3 million to 1.4 million range.

The highlights of the 2021 guidance are below.

- Production of 1,300,000 – 1,400,000 ounces (2020 guidance: 1,350,000 – 1,400,000 ounces including 29,391 ounces from Holt Complex)

- Operating cash costs per ounce sold of $450 – $475 (2020 guidance: $410 – $430)

- AISC per ounce sold of $790 – $810 (2020 guidance: $790 – $810)

- Sustaining capital expenditures of $280 – $310 million (2020 guidance: $390 – $400 million)

- Growth capital expenditures of $250 – $275 million (2020 guidance: $95 – $105 million)

- Exploration expenditures of $170 – $190 million (2020 guidance: $130 – $150 million).

Kirkland Lake currently has 11 analysts covering the company with a weighted 12-month price target of C$78.08. This is down from the average one month ago, which was C$81.21. Three analysts have strong buy ratings while the other eight have buy ratings.

Several analyst have modified their ratings in light of the production guidance, including the following.

- National Bank of Canada cuts target price to C$71 from C$72

- RBC cuts target price to $55 from $64

- BMO cuts target price to C$85 from C$100

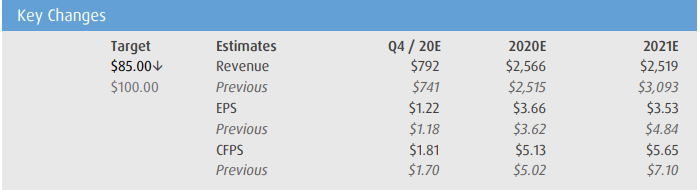

BMO’s analyst Brian Quast, who reiterated their outperform rating but downgraded their price target, says that they negatively view the guidance. Specifically, 2021 and 2022 production and the all-in sustaining cost are below expectations, but 2023 is higher.

Quast adds that 2021 is shaping up to be a heavy year of capital investment totaling somewhere around U$750 million., in addition to the U$200 million the company will pay out in 2021 due to dividends.

Quast says, “The primary driver of this divergence is guided production at Fosterville of 400-425 Koz, which is materially below BMO’s estimate of 606 Koz.” Still, Detour Lakes production came as a surprise to them as their estimate is 620k ounces versus the guidance of 680-720k ounces. Quast has revised their 2021 estimates and now estimates that Kirkland Lake will produce 1,311,000 ounces at an all-in sustaining cost of U$809/ounce.

Below you can see the key changes Quast has made to their 2020 and 2021 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.