Last week, Kirkland Lake Gold (TSX: KL) announced their fourth quarter and full year 2021 results. The company reported a record quarterly production of 369.4 thousand ounces, with net earnings of $232.6 million and an $0.86 net earnings per share. For the full year, they reported 1.37 million ounces produced with net earnings of $787.7 million and adjusted net earnings per share of $3.41.

Kirkland Gold currently has 12 analysts covering the company with a weighted 12-month price target of C$74.27. This is down from the average before the results, which was C$76.27. Three analysts have strong buys while another eight have buy ratings and only one analyst has a sell rating

In Canaccord’s flash update, Carey MacRury, their mining and metals analyst, says that the results were slightly better or in-line. They reiterated their C$75 price target and buy rating on the name.

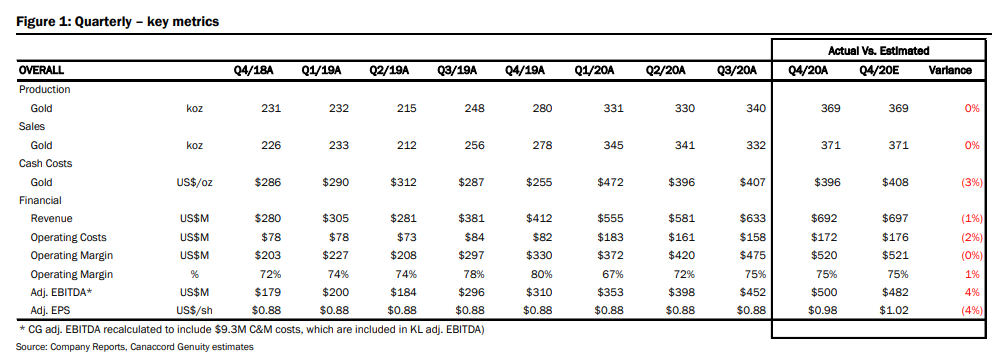

Adjusted quarterly earnings per share came in slightly below their $0.98 per share at $1.02, although MacRury notes that Kirkland adjusts out $10 million/ $0.03 per share in depreciation. Adjusted EBITDA came in at $500 million, above their $482 million and the consensus $489 million. MacRury says that the EBTIDA beat was mainly driven by “slightly lower operating costs and lower G&A and exploration expense.”

Kirkland also came in-line with their fourth quarter and full year production estimates, while they did beat Canaccord’s cash cost estimate of $408 per ounce, with their cash costs being just $396 per ounce.

The last thing MacRury says is that Kirkland had a strong balance sheet, with cash being flat quarter over quarter, no debt, even though Kirkland returned almost $280 million to shareholders in the fourth quarter.

Below you can see Kirkalnds results versus Canaccord’s estimates.

Onto Stifel-GMP’s note, Ian Parkinson reiterated their C$79 price target and buy rating. Most of the note is very similar to that of Canaccord’s other than that they believe that Detour is coming into focus at the right time.

With the intercepts being “near-surface above reserve grade mineralization over significant intervals, as well as deeper rooted mineralization” and the recent permit that allows Kirkland to process up to 90ktpd, up from 63kpd. Parkinson writes, “this could boost the asset to annual production of around 800kozpa by 2025. The company’s near term FCF profile is highly influenced by the grade profile of Detour.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.