Earlier this week, Denison Mines Corp. (TSX: DML) announced that they sent an offer to Overseas Uranium Resources to acquire 100% ownership in its JCU Exploration Company. The company owns a number of uranium JV’s in Canada including a 10% interest in Denison’s Wheeler River project. Denison’s offer is for $40.5 million in cash which is broken down into $10 million upon signing the agreement, $28 million upon closing and $2.5 million in working capital adjustments payable 45 days after close.

In Canaccord’s flash update, their analyst Katie Lachapelle, who has a C$2 12-month price target on the company and a speculative buy rating, says that the two companies make a great match and, “is unlikely to be met by a competing bid from UEX, given a purchase price of more than 3x UEX’s offer.” She says that the rationale is clear as Denison will be able to have a 100% stake in its flagship project and says that alone justifies the acquisition but adds, “We see the benefit to Denison consolidating 100% ownership of Wheeler River, with respect to negotiating a future financing agreement and/or partnership.”

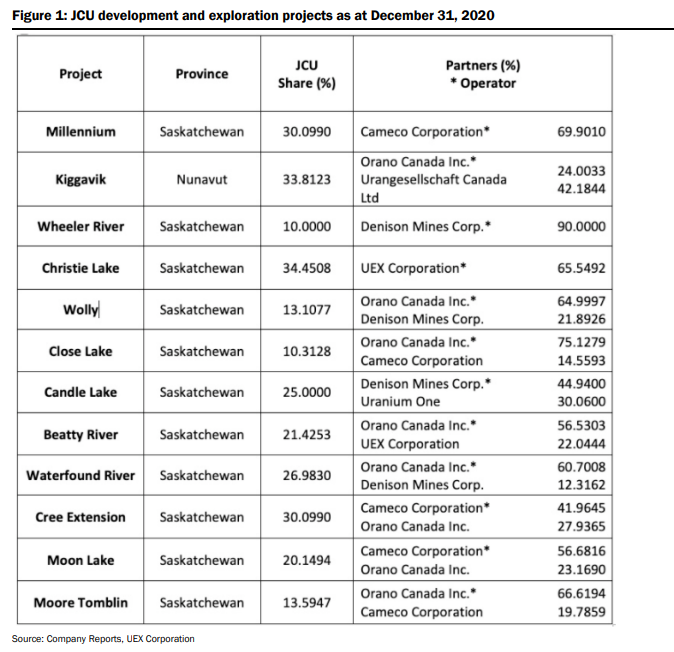

Below you can see the additional joint ventures JCU has which includes a 30% stake of Millennium, 33.812% of the Kiggavik project, and 34.451% of Christie Lake. Lachapelle says the projects, “represent some of the better-undeveloped projects in Canada and are all well advanced with strong JV partners.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.