Last week, Kirkland Lake Gold (TSX: KL) gold released its third quarter results. The company reported an adjusted earnings per share of $0.91 and revenue of $632.8 million, which was up 66% year over year. Quarterly gold production was 339,584 ounces, up 37% year over year and 3% higher than last quarter.

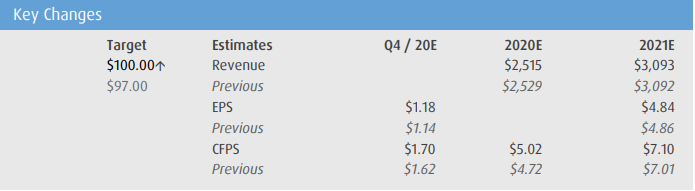

BMO Capital Market’s analyst Brian Quast upgraded their 12-month price target to C$100 from C$97 while reiterating their outperform rating on the company. Quast headlines, “In-Line Q3/20 Earnings; Even Stronger Balance Sheet.”

The $0.91 adjusted earnings per share (EPS) was slightly below BMO’s estimate of $0.95. Quast says that the production number of 339.6 thousand ounces was lower due to Macassa producing only 38 thousand ounces. This is because of “record heat and continued COVID-19 safety procedures, which caused both lower grades and tonnes processed.” The lower production at Macassa was partially offset by the higher than expected production at Fosterville.

Kirkland’s all-in sustaining cost of $886/ounce and cash costs of $406/ounce beat BMO’s estimates of $914/ounce and $488/ounce, respectively. Quast says that “lower ounces and operational issues at Macassa resulted in higher costs per ounce, coming in 13.4% above BMO’s estimates,” but Fosterville and Detour Lake beat all-in sustaining cost estimates by 12.2% and 8.9%, respectively.

Quast then talks about their balance sheet as he says, “Kirkland Lake’s already-solid balance sheet was strengthen by cash flow from operations of $431M during the quarter.”

Below you can see BMO’s estimate changes for full year 2020 and 2021

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.