One would assume the cyclical recessions that occur every 7-10 years or so would be nothing but smooth sailing for corporations, especially after being given ample opportunities to learn that reckless share repurchases lead to nothing but bankruptcy. Well, it appears that exactly zero of those lessons have been learned, as stock buybacks are once again soaring despite the extensive list of taxpayer bailout requests that ensued only a year ago.

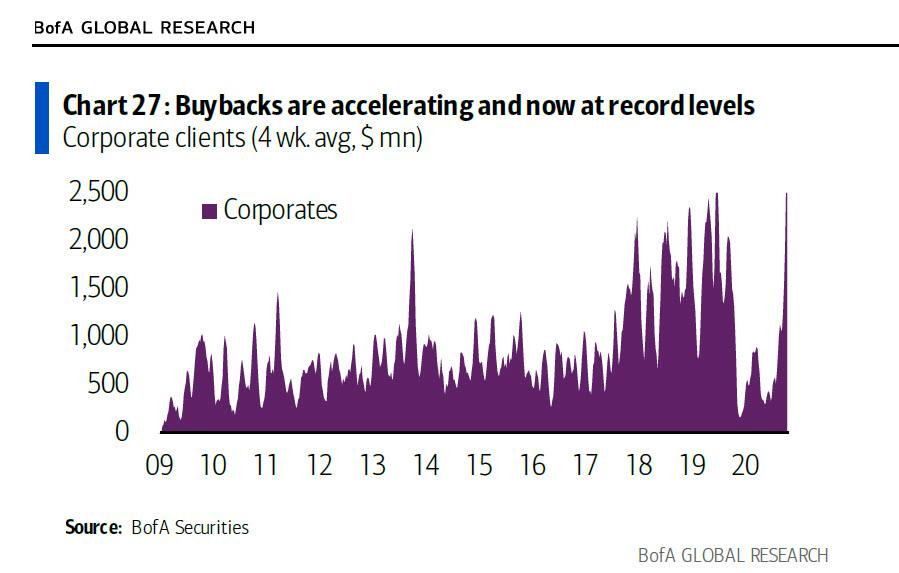

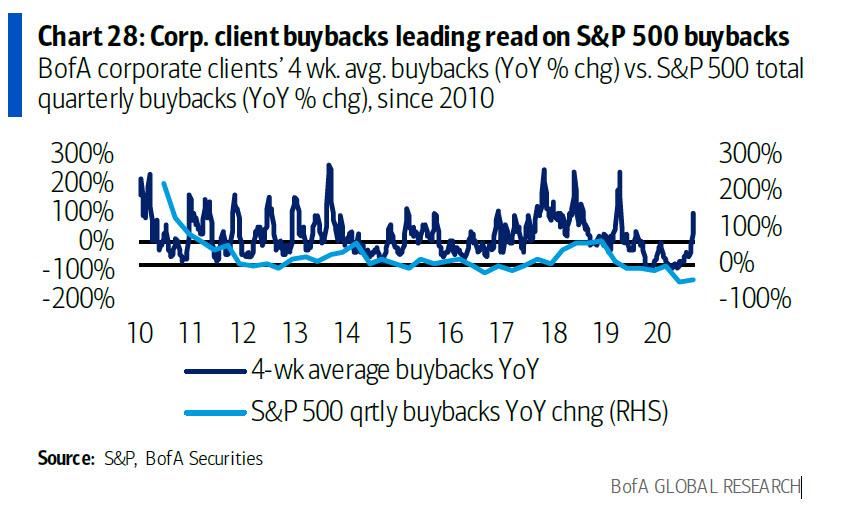

Wall Street, the place where poor management actions and tax-payer funded bailouts are synonymous, appears to be functioning back to normal abnormal— that is, stock repurchases are once again soaring. According to the latest Bank of America Client Flow report, the recent rebound in stock repurchases (aside from a moderate decline in the prior week) have pushed the four-week average buyback to the highest on records dating back to June 2009.

More extraordinary though, is that year-to-date buybacks are back to the same levels recorded at this time a year go. Of course, lessons are difficult to learn when there are no consequences— as the majority of buybacks continue to remain debt-funded by the very same corporations that will soberly beg for bailouts in the next market collapse once they face bankruptcy (again).

So, not only is the share repurchase mania back, but the Fed is injecting a record $120 billion in liquidity into the markets per month until 2022. In short, have no worry: everything at Wall Street is back to its pre-pandemic velocity— and then some.

Information for this briefing was found via the BofA. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.