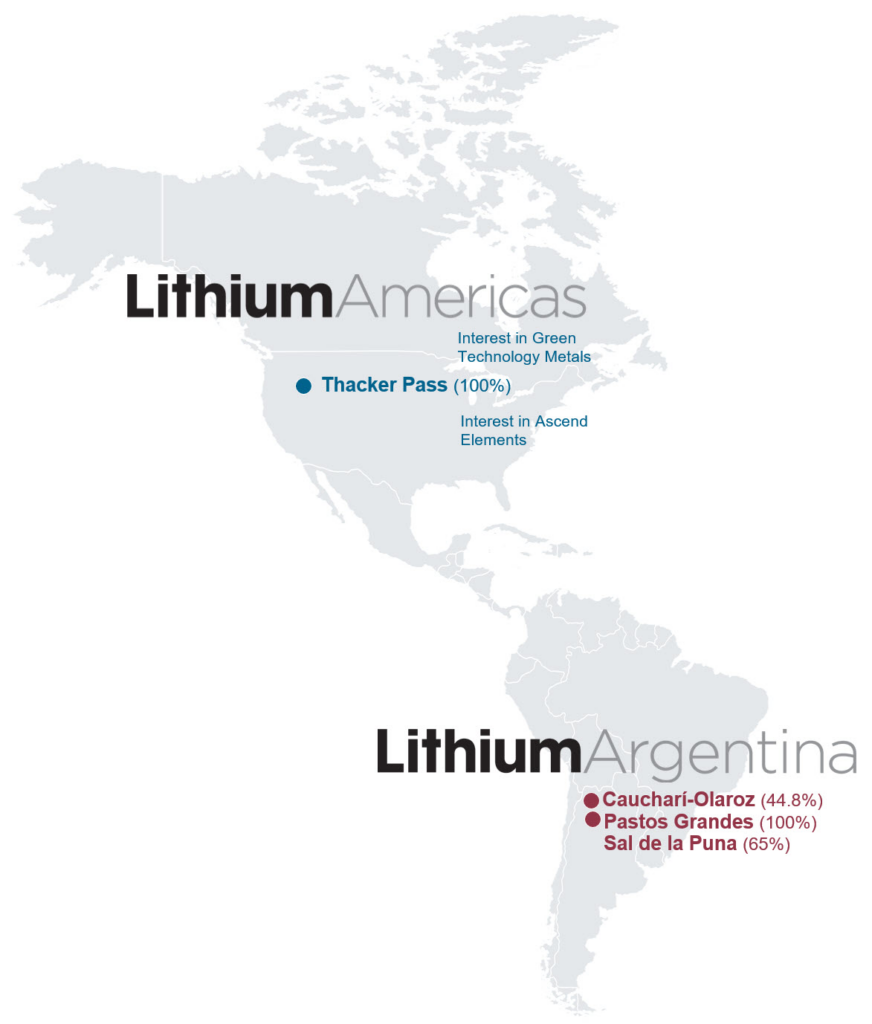

Lithium Americas (TSX: LAC) announced on Monday that the company’s board has unanimously approved the deal to split its North American and Argentine business units into two independent public companies.

Lithium Argentina will hold Lithium Americas’ present investment in its Argentina lithium assets, including a 44.8% stake in Cauchar-Olaroz, a 100% stake in Pastos Grandes, and a 65% stake in Sal de la Puna. On the other hand, the new Lithium Americas will be the sole owner of the Thacker Pass lithium project in Humboldt County, Nevada, as well as interests in Green Technology Metals Limited and Ascend Elements, Inc.

“With this approval by the Board of Directors, we are excited to clear a key milestone in moving forward to separate Lithium Americas into two distinct leading lithium companies,” said Jonathan Evans, President and CEO of Lithium Americas.

The new Lithium Americas will still be headed by Evans with Pablo Mercado still serving as CFO. Lithium Argentina will be headed Executive Vice Chair John Kanellitsas as interim CEO with VP for Finance Alex Shulga as CFO.

The split is expected to have the North American company focus on the construction and production of Phase 1 of Thacker Pass, and planning and execution of Phase 2 and beyond.

The firm’s Argentine business meanwhile is expected to focus on the ramp-up of Caucharí-Olaroz, the pursuit of Stage 2 expansion and further growth with the significant resource.

Cauchari-Olaroz is slated to ramp production through the second half of the year, before hitting a run rate of 40,000 tpa of lithium carbonate production by the first quarter of 2024. Construction is said to be substantially complete, with production slated to begin in the first half of 2023.

The Chinese angle

The decision to divide Lithium Americas reportedly came down to one tough issue: US-China relations. If shareholders approve the split, it will essentially remove itself from one of its main shareholders, Ganfeng Lithium Group Co., a Chinese manufacturer of the white, silvery metal. In 2017, Ganfeng formed a partnership with Lithium Americas to help advance the project in Argentina.

Ganfeng is a “smart, dedicated” partner, according to Lithium Americas’ executive vice chair, John Kanellitsas. However, Kanellitsas stated that Lithium Americas needed to break relations with Ganfeng in order to establish the Thacker Pass mine in Nevada, a project that has received a $650 million investment from General Motors Co. as the US works to build a domestic supply chain for electric vehicles.

Lithium Americas has since filed for funding from the US Department of Energy, which has set aside hundreds of millions of dollars for initiatives using battery metals.

“What makes it problematic, optics wise — and optics matter — is when the beneficial owners of those Department of Energy funds are Chinese shareholders,” Kanellitsas said. “You can only imagine a press release saying here, ‘Lithium Americas and Ganfeng announce a new joint venture’ — it just would not fly at all, especially given what we’re trying to accomplish here in North America.”

As they compete with China for access to crucial minerals, the United States and its allies have tightened restrictions on Chinese mining investment. The separation of Lithium Americas, which is anticipated to be completed this year, comes just one day after the Canadian government ordered three Chinese businesses to sell their shares in the country’s lithium miners.

The separation deal is still subject to shareholders’ or regulatory approvals.

Still at a loss

The split deal comes as the mining firm reported its financials for Q1 2023, headlined with a loss of $6.4 million. This compares to a net loss of $46.1 million in Q1 2022.

The Vancouver, British Columbia-based corporation reported a $0.04 loss per share versus last year’s $0.35 loss per share.

The outcomes exceeded Wall Street’s expectations. According to Zacks Investment Research, the average forecast of three analysts polled was a loss of 19 cents per share.

The firm said the net loss decreased in Q1 2023 principally owing to a gain on change in fair value of the purchase agreement with General Motors Holdings agreements derivative liability as well as a gain on change in fair value of the convertible note derivative versus loss in the previous period.

Lithium Americas last traded at $30.00 on the TSX.

Information for this briefing was found via Edgar, Bloomberg, and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.