Late last week, the U.S. Bureau of Land Management (BLM) gave final approval to Lithium Americas’ (TSX: LAC) Thacker Pass battery-grade lithium carbonate project in Nevada. With this affirmation in hand and factoring in the construction time for the mine, commercial production could potentially begin in late 2022.

The BLM’s decision came in the waning days of the Trump Administration as part of the former president’s push to approve mining projects before the handover of executive power on January 20, 2021. President Biden has already moved to overturn several of Mr. Trump’s “non pro-environment” decisions, including the revocation of a permit granted to the Keystone XL oil pipeline expansion (a 1,700-mile route from Alberta to the U.S. Gulf Coast), and the imposition of a temporary moratorium on oil and gas leasing in the Arctic.

However, President Biden is considered a champion of “green energy” metals, of which lithium is among the most prominent. So, a rollback of the BLM’s ruling on Thacker Pass is considered unlikely.

In a move likely related to the Nevada mine approval and to Thacker Pass and Cauchari-Olaroz (see below) construction costs, Lithium Americas completed a US$350 million overnight equity raise on January 20. The company sold 15.9 million shares at US$22.00 per share in an underwritten public offering.

Why is Lithium Supply So Important to Electric Vehicle (EV) Manufacturers?

Lithium is refined from lithium carbonate, which is, in basic terms, a salt that is stable. One hundred kilograms (kg) of lithium carbonate can produce about 19 kg of lithium metal. A lithium-ion EV battery contains around 10 kg of lithium metal.

According to Statista, about 92 million motor vehicles were manufactured on a worldwide basis in 2019. If, as Elon Musk of Tesla has theorized, 30% of those sales eventually transition to EV’s powered by a Li-ion battery, about 1.6 million tonnes of lithium carbonate must be mined each year, or more than five times the total lithium carbonate mined across the globe in 2019, per Morgan Stanley. (Lithium carbonate is also used in the manufacture of glass, cement, adhesives and aluminum.)

Lithium Americas’ Projects

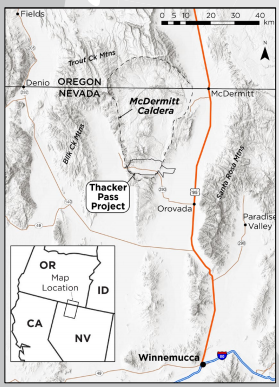

Lithium Americas owns 49% of the Cauchari-Olaroz lithium brine project in Argentina. China’s largest lithium company, Ganfeng Lithium, owns the balance, or 51%. The Argentine facility is expected to be completed by year-end 2021 (currently more than 60% finished) and is forecast to produce 40,000 tonnes of battery-grade lithium carbonate annually for 40 years. Offtake agreements are in place for 90%+ of production. Total construction costs should be around US$565 million.

Thacker Pass may produce 60,000 tonnes of battery-grade lithium carbonate per year over an even longer period, 46 years. Phase 1 construction costs for the Lithium Americas 100%-owned project are projected to be US$581 million.

Strong Balance Sheet

Factoring in the recent US$350 million offering, Lithium Americas has net cash of around US$300 million. It is a pre-revenue company, so it generates negative operating income and operating cash flow. Lithium Americas’ operating cash flow deficit averaged about US$8 million per quarter over the first nine months of 2020, but that shortfall is relatively modest in relation to its cash position. Cash flow should turn positive in early 2022 as the Cauchari-Olaroz project begins commercial production.

| (in thousands of US $, except for shares outstanding) | 3Q 2020 | 2Q 2020 | 1Q 2020 | 4Q 2019 | 3Q 2019 |

| Operating Income | ($5,743) | ($6,494) | ($10,312) | $11,073 | ($3,311) |

| Operating Cash Flow | (7,204) | (8,355) | (8,214) | (4,094) | (4,217) |

| Cash – Period End | 71,888 | 49,719 | 82,122 | 83,614 | 108,152 |

| Debt – Period End | 122,294 | 151,371 | 150,076 | 114,999 | 111,005 |

| Shares Outstanding (Millions) | 91.4 | 90.6 | 90.0 | 89.8 | 89.3 |

It is possible that EV makers could eventually decide that traditional nickel-manganese-cobalt batteries are preferable to those with a heavy lithium content and no cobalt or nickel (even though cobalt production is decidedly unfriendly to the environment). In that case, a lithium miner like Lithium Americas would be disadvantaged.

The BLM’s recent approval of Thacker Pass could mean that Lithium Americas will have two significant facilities in place in 2022 to produce a commodity which promises to be in high demand, and for which supply currently seems quite limited. Total annualized production at the company’s facilities could equal about one-quarter of all lithium carbonate produced in 2019.

Lithium Americas last traded at $28.96 on the TSX Exchange.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.