China’s lithium industry is in disarray as its biggest production hub, which accounts for roughly a tenth of global supply, threatens sweeping shutdowns due to a government investigation into environmental violations.

The crackdown in Yichun, Jiangxi province, comes after a year of local lithium frenzy as miners rushed to meet soaring demand for the battery element – and profit from record global prices. They are currently dealing with close scrutiny by Beijing-sent environmental officials.

Ore-processing operations in Yichun have been halted as investigators investigate alleged infractions at lithium mines, according to the Yicai newspaper. According to various analyst estimates, this threatens between 8% and 13% of world supply, however it’s unclear how long the emergency shutdowns will last.

The Beijing officials are said to be mainly examining infractions at lithium mines and seek to guide the “healthy development” of the industry, according to the Yicai report. It will primarily target individuals mining without permissions or with expired licenses.

Some miners allowed to restart

According to a report in the local media outlet Cailian, some mines have been allowed to reopen despite the government probe.

The media outlet reported that all mines with legitimate government permits have already resumed production, citing unnamed mining company sources.

The Chinese investigation adds uncertainty to a lithium market that is seeing prices fall — providing some comfort to EV producers — as more global output emerges. The lithium-bearing mineral lepidolite was supposed to be a key source of extra supply in Jiangxi province.

According to an academic study published in the journal China Geology, lepidolite will account for roughly one-fifth of China’s lithium output in 2021. Per the study, the lepidolite rocks in Yichun contain less than 1% lithium. This is a low level, which makes extraction more energy-intensive and costly.

The lithium situation

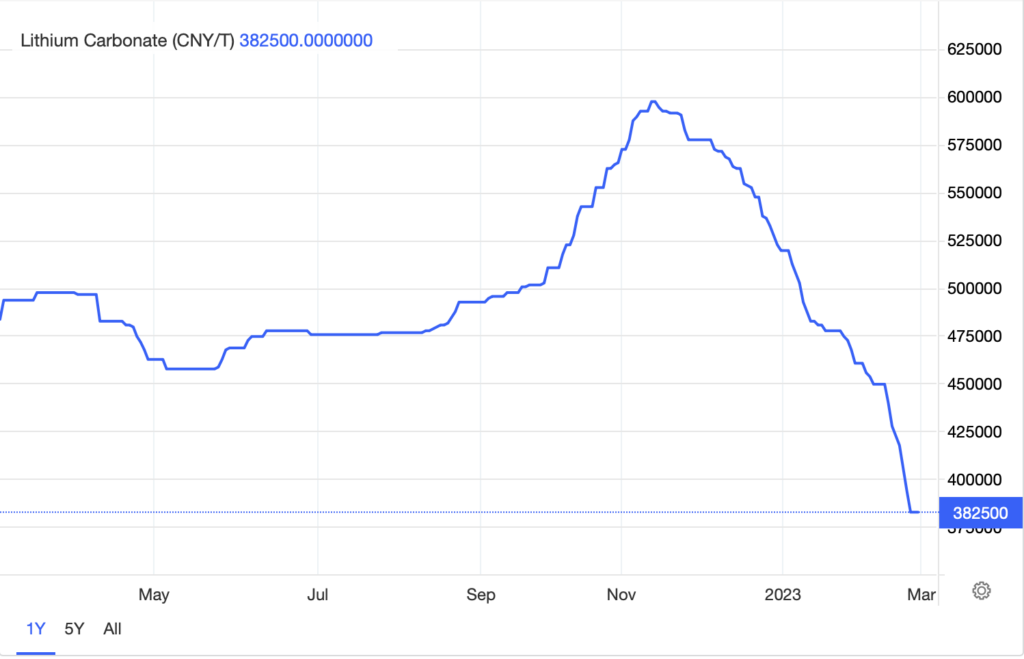

Lithium carbonate prices in China fell to CNY 382,500 per tonne in late February, shedding more than one-third of their value in the previous three months to hit a one-year low as higher supply and weak demand prospects increased the likelihood of a market surplus this year.

“In the overall sector, what’s really happening is that lithium is in a bubble,” John-Mark Staude, CEO of Riverside Resources (TSXV: RRI) said in a Daily Dive interview. “It’s just so hot right now… we have so much going on in the lithium space that it feels pretty heavy right now. We definitely see that people are selling and trying to do different things, it’s only a number of producers that can make it to market.”

He added that there’s “so much momentum in lithium… but it feels like we’re in a bubble.”

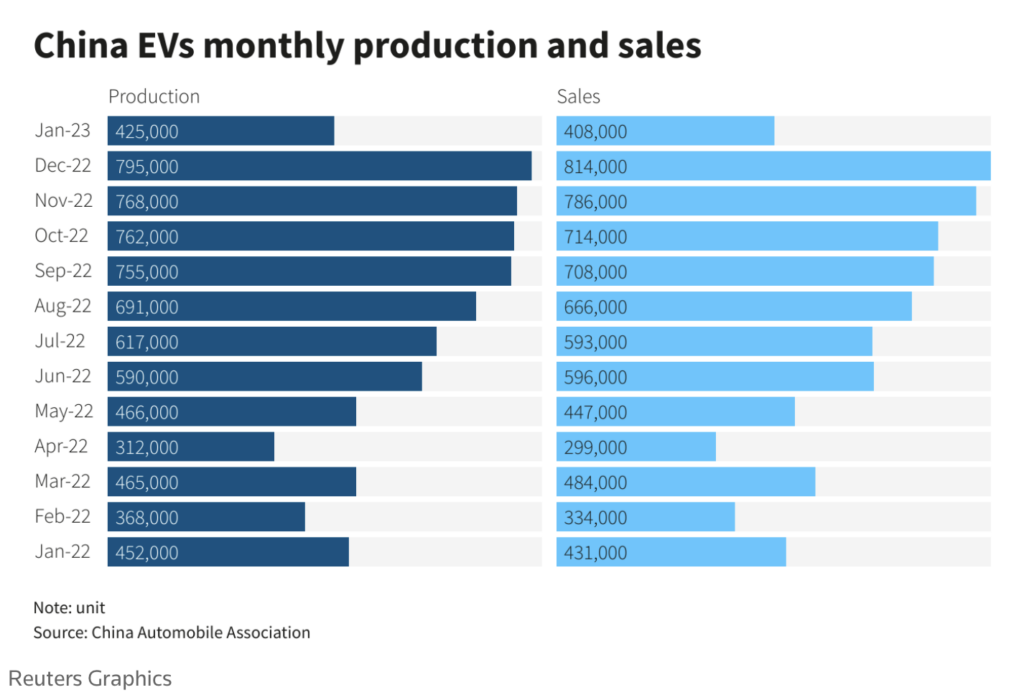

Late last year, electric vehicle demand in China dropped considerably ahead of Beijing’s expected suspension of subsidies for the $87 billion industry, the world’s largest and fastest expanding.

Analysts believe the slump accelerated as investors were alarmed by a decrease in China’s January electric vehicle sales and by top battery producer CATL’s discount conditions, which included a forecast that lithium carbonate prices, a crucial component in auto batteries, would more than halve.

Notwithstanding concerns about demand, analysts believe that coming supply from China, Australia, and Chile will bring prices back down to earth.

Rystad Energy expects the worldwide lithium market deficit will be around 20,000 to 30,000 tonnes of lithium carbonate equivalent this year, down from 76,000 tonnes LCE in 2022. Goldman Sachs meanwhile expects spot prices of lithium carbonate, a precursor to the compound used in lithium-ion batteries, to fall to $34,000 per tonne in the next year, down from an average of $53,304 this year.

Up to 2025, lithium supply is expected to expand at a 34% annual rate, compared to a 25% annual demand growth rate.

According to four China-based analysts and five merchants, purchasers, and producers, lithium prices are anticipated to fall to 300,000 yuan by the end of this year, around half the level they peaked at in November 2022.

Information for this briefing was found via Bloomberg, Reuters, Mining.com, and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.