The mid-December 2021 electoral victory of Gabriel Boric, a 35-year-old leftist candidate and former student protest leader, to Chile’s presidency seems to be boosting an already buoyant market for lithium. Lithium is a key component of the cathode in most electric vehicle (EV) batteries, and demand is expected to grow almost geometrically over the foreseeable future.

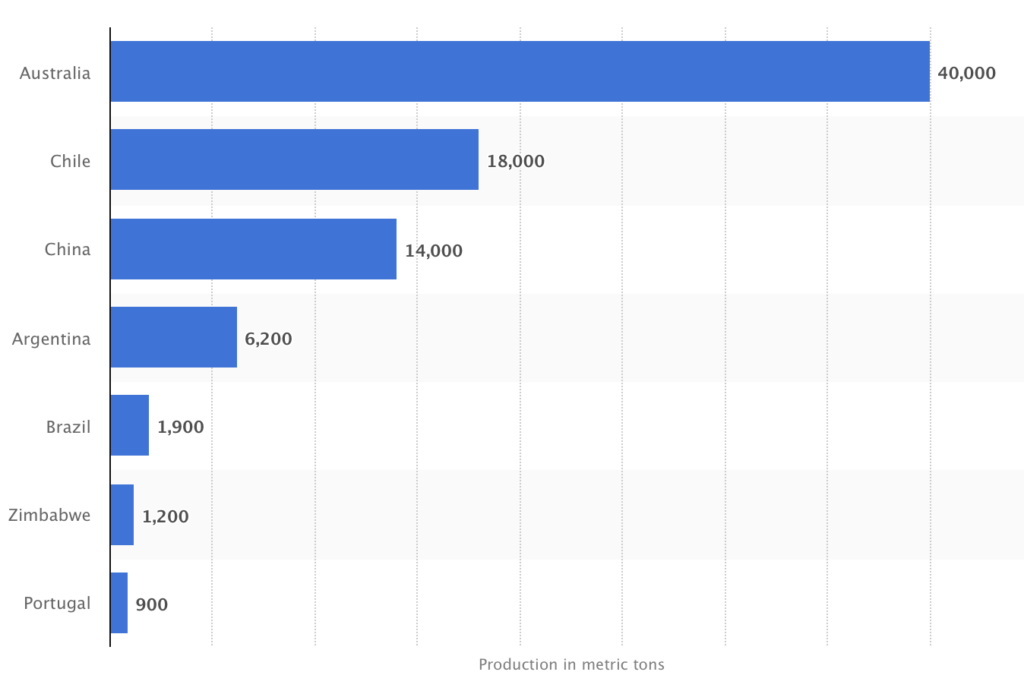

Chile produces more than 20% of the world’s lithium and contains just over half of the globe’s reserves. Most of these reserves are found in brine that flows beneath the country’s remote Atacama Desert.

Mr. Boric, who takes office on March 11, 2022, campaigned on a platform of overhauling the country’s market-oriented economic system. He also promised to expand the country’s social net, including narrowing the nation’s wide income gap between the rich and poor, and to implement pro-environment and pro-climate measures. This last issue tapped into many Chileans’ concerns about the social and environmental risks of lithium extraction.

To date, Chile’s incoming leader has not discussed his specific plans for the lithium industry, except to make what sounds like a scary, possibly supply-disrupting proposal: the potential creation of a national lithium company. Currently, two companies, Albemarle Corporation (NYSE: ALB) and Sociedad Quimica y Minera de Chile S.A. (NYSE: SQM), produce lithium under contracts with the government.

There is a precedent for such a nationalization in Chile. Codelco, a state-owned copper mining company, was formed in 1976 from foreign-owned copper companies that were nationalized in 1971. The nationalization plan was implemented by Marxist ex-president Salvador Allende. Codelco is the largest copper-producing company in the world.

Hints of an impending less friendly climate toward lithium extraction are already evident. On January 4, 2022, a group of left-of-center lawmakers filed an objection with a Santiago appeals court to a bid request put forth by the current administration to expand lithium production in the country. Winning bidders would receive 20+ year lithium extraction contracts. On January 7, the court rejected the lawmakers’ objections, saying the time allowed for appealing the bid process had expired.

In addition, on January 5, a centrist Chilean party introduced a bill in Chile’s legislature that would prevent a sitting president from soliciting new mining contract bids in the final 90 days of his/her term. As noted above, President Pinera’s term expires March 10, 2022.

Lithium markets seem well aware of future potential production issues in the rich production region of Chile. Lithium prices, already up 160% since the end of July 2021 based on future EV-based lithium demand, have soared more than 25% since just the December 19, 2021 election of the new Chilean president and show no signs of slowing.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.