Shares of Lordstown Motors Corp. (NASDAQ: RIDE), the Ohio-based manufacturer of the Endurance electric vehicle (EV) full-size pickup truck, peaked in February when investor interest in EV’s was unusually intense. The company has come under further selling pressure since a short seller published a scathing research report on March 12.

Specifically, Hindenburg Research purports that the pre-orders that Lordstown received for the Endurance pickup truck are “largely fictitious.” In January, Lordstown Motors announced that it had surpassed 100,000 “non-binding production reservations” from commercial fleets for the Endurance pickup truck.

Perhaps surprisingly for CEO and Founder Steve Burns, who has frequently courted media coverage, Lordstown Motors has kept largely mum about the report’s allegations, saying only that it was aware of its content and that it had received a request for information from the United States SEC. The company’s only real response so far: its board has set up a special committee to evaluate the short seller’s allegations. The company will comment only when that committee has finished its work.

Lordstown Motors Strategy

Lordstown Motors’ plans to focus on the light-duty truck segment in North America, as opposed to more traditional sedans, is predicated on consumers’ interest in the truck segment. Indeed, of the 20 top-selling vehicles in the United States in 2020, just four were sedans; eleven were crossover vehicles or SUVs; and five were pickups — including each of the three biggest sellers (Ford F-Series, the Chevrolet Silverado and Chrysler’s Ram Pickup). Despite their popularity, pickup trucks are expensive to operate, as they are traditionally huge consumers of fuel. In contrast, the Endurance pickup truck’s energy consumption is equivalent to about 75 miles per gallon of gasoline.

The Endurance™ model has a unique design. Its chassis has only four moving parts — in-wheel hub motors created by Elaphe Propulsion Technologies in each of its four wheels. In this way, the Endurance will have among the fewest parts of any highway-capable production vehicle ever made. The company believes this will positively affect its performance and range and reduce operating and maintenance costs.

Lordstown Motors plans to build its pickup truck in a 785-acre former GM assembly plant in Lordstown, Ohio. Manufacturing lines and necessary equipment are already in place. Production lines for the in-wheel motors and lithium-ion battery packs are being added to the facility. This work should be completed in time for Endurance commercial production to begin in September 2021.

The first beta vehicles were delivered for durability, crash and other testing in late March 2021, and another batch is expected to be delivered to initial customers in May 2021. Feedback on these beta vehicles should be received sometime in 2Q 2021.

The Endurance pickup truck is expected to have a base retail price of US$52,500. If a U.S. federal tax credit of US$7,500 remains in place for the purchase of alternative fuel vehicles, a US consumer would pay a net US$45,000 for the truck.

This summer, Lordstown Motors should unveil the prototype of its second vehicle, an EV van. Commercial production of the van could commence in the second half of 2022.

Cash-Rich Balance Sheet

Lordstown Motors had a net cash balance of about US$629 million as of December 31, 2020. Its operating cash flow deficit was only US$64 million in 2020, but that cash burn rate is expected to increase significantly in 2021 as the company gears up for the production of its EV pickup truck.

| (in thousands of US $, except for shares outstanding) | Year Ended December 31, 2020 |

| Operating Income | ($102,481) |

| Operating Cash Flow | ($64,320) |

| Cash – Period End | $629,761 |

| Debt – Period End | $1,015 |

| Shares Outstanding (Millions) | 168.0 |

Relative Performance of Lordstown Motors

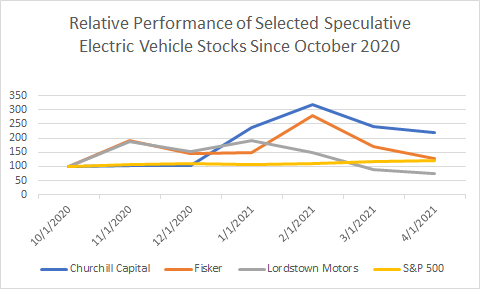

In the figure below, the relative performance of Lordstown Motors’ stock since October 2020 is shown versus that of Churchill Capital Corp IV (NYSE: CCIV), the SPAC partner of Lucid Motors; Fisker, Inc. (NYSE: FSR), another popular EV play; and the S&P 500. The S&P 500 and each of the stock prices are presented in index form where 100 is the uniform starting point.

Lordstown Motors has noticeably underperformed all the securities shown. Fisker has approximately matched the S&P 500’s performance, and Churchill Capital has shown the strongest returns by far.

The chief risk for Lordstowm Motors is the issue discussed by the short seller in March – the true quantity and quality of its orders. If it is determined that the short seller is correct, Lordstown Motors shares could suffer further.

Lordstown Motors plans to produce a potentially pathbreaking vehicle for which there could a significant market. Due to a dimming of investor enthusiasm toward the EV industry (from a very high level) and uncertainty about the company’s true order level, Lordstown’s enterprise value has declined to about US$1 billion from US$4.7 billion in just 2 ½ months. If Lordstown Motor’s actual orders prove to be robust, its valuation could potentially reverse again to higher levels.

Lordstown Motors last traded at US$7.99 on the NASDAQ.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.