On April 22, the U.S. National Highway Traffic Safety Administration (NHTSA) moved to reverse a Trump Administration action that pre-empted the ability of individual U.S. states, including the influential state of California, from issuing their own limits on greenhouse gas emissions and mandates regarding zero-emission vehicles. Automakers had successfully petitioned then-President Trump in 2019 for this relief.

Prior to the Trump Administration’s decision, the federal government had abided by language in the landmark U.S. Clean Air Act, enacted in 1970, that permitted California, the nation’s biggest car market, to set its own car emission standards – standards that invariably exceeded federal guidelines. Consequently, California requirements effectively became the national requirements for car makers over the last 50 years.

The Biden Administration’s decision to reverse the Trump-era temporary edict has positive implications for electric vehicle (EV) manufacturers like Lucid Motors, as California’s tougher emissions standards will again become the national model. Indeed, President Biden has been an ardent supporter of the EV industry, including through his US$2 trillion infrastructure plan that includes US$174 billion in spending to boost the U.S. EV industry. Lucid is a very well-capitalized, pre-revenue, private luxury EV start-up company.

Lucid Background Information

A special purpose acquisition company (SPAC) deal was finalized on February 22 between Churchill Capital Corp IV (NYSE: CCIV) and Lucid. Lucid plans to deliver its first Lucid Air model to customers in the second half of this year. The Lucid Air’s price starts at US$69,900, after a potential US$7,500 tax credit.

The equity value of the February Churchill Capital-Lucid deal was announced at US$16.3 billion, and existing Lucid shareholders will receive a value of US$11.75 billion. Factoring in the stakes of the PIPE (Private Investment in Public Equity) investors and the original Churchill Capital SPAC investors, the deal values Lucid Motors at US$24 billion. When the deal closes, likely this quarter, the stock will trade under the symbol LCID. At that time, Lucid could have US$4.5 billion of cash to fund its initiatives.

According to its own projections, Lucid will not turn EBITDA positive or free cash flow positive until 2024 and 2025, respectively. By 2025 and 2026, the company hopes to realize gross margins of 22-23%, less than the margins earned by leading technology companies. By 2026, the company could generate US$2.9 billion of EBITDA and US$1.5 billion of free cash flow.

Lucid expects to sell 20,000 EVs in 2022. According to management, that figures ramps to 251,000 cars by 2026. No production issues such as parts shortages or labor issues are foreseen over the next five years (even though battery availability continues to be an obstacle for many EV makers).

Speculation of Possible Future Linkage Between Lucid Motors and Apple

Rumors on social media persist that a linkage may develop in the future between Lucid and Apple Inc. The chief basis for such thoughts appears to be that Apple’s former chief designer, Sir Jony Ive, is now an operating partner at Churchill Capital. In an early April interview with The Guardian, Lucid CEO Peter Rawlinson declined to comment on any potential relationship between Lucid and Apple.

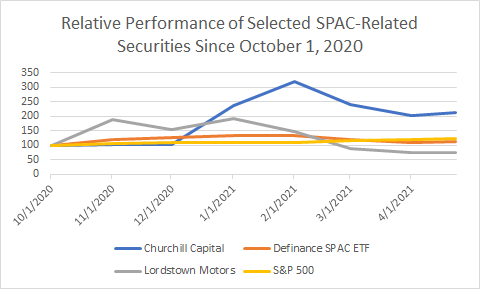

Relative Performance of Churchill Capital Corp IV

Since late January/early February, shares of many SPACs, including Churchill Capital Corp IV, have noticeably declined. In the figure below, the relative performance of Churchill Capital since October 1, 2020 is shown versus that of Lordstown Motors Corp. (NASDAQ: RIDE), another popular EV play; the Defiance Next Gen SPAC Derived ETF (NYSE Arca: SPAK), which broadly tracks SPAC performance; and the S&P 500. The S&P 500 and each of the stock prices are presented in index form where 100 is the uniform starting point.

Churchill Capital has noticeably underperformed both SPAK and the broad stock market over the last few months, but it has outperformed Lordstown Motors (by declining less).

The Biden Administration’s continued embrace of the EV industry is a positive for Lucid and Churchill Capital. In addition, Churchill Capital Corp IV’s stock has corrected significantly over the last two months. If the SPAC deal closes this quarter, and if Lucid Motors does begin delivering its Lucid Air model to customers in 2H 2021, the stock could begin to perform better.

Churchill Capital IV Corp. (NYSE: CCIV) last traded at US$20.55 on the NYSE.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.