Ark Invest chief Cathie Wood is putting a lot more faith in Tesla (Nasdaq: TSLA) in this cycle. The fund manager last week made a prediction that the American carmaker’s stock would go up eight-fold following the rise of artificial intelligence technology, which lately has been led by OpenAI and its revolutionary large language model ChatGPT.

“The world is changing incredibly quickly here,” Wood said on Fox Business. “We’re seeing this with AI of course, all the news around ChatGPT that’s captured the public’s imagination and captured businesses’ imagination, it’s happening very quickly, and our portfolios are very focused on the future.”

When asked if she would be poised to “lessen exposure to Tesla” as she increases exposure to AI ChatGPT plays, Wood was quick to defend the carmaker.

“Actually, Tesla is one of the most profound AI companies out there — that’s why it’s at the top of ARKK, ARKQ, ARKW has a big position in it as well,” Wood said on Fox Business. “It is not an auto company, it is a technology company.”

READ: Cathie Wood’s Big Ideas 2023 Sees Disruptive Innovation To Be Bigger Than Global GDP

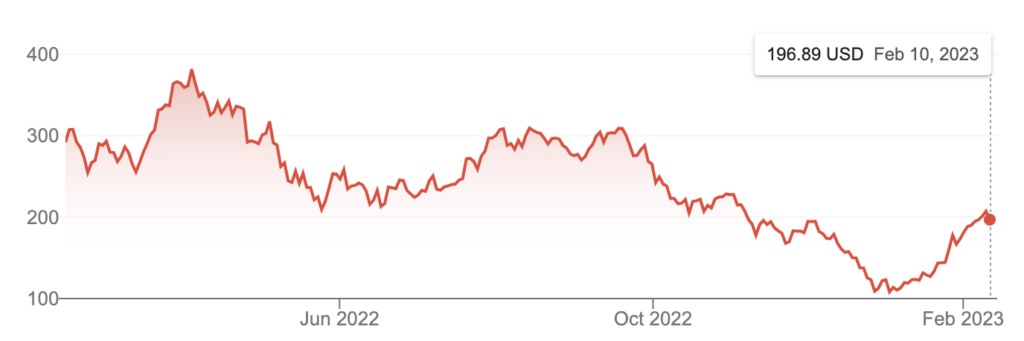

Tesla stock is up more than 80% since the beginning of the year, but is still down over 30% year over year, and around 52% from its peak of just over $407 in November 2021.

Tesla CEO Elon Musk has previously described Tesla not as a car company but as an AI company with its increasing focus on AI and robotics. But in terms of what it’s actually demonstrably great at, it’s arguable that Tesla, primarily Musk, is still better at marketing than AI these days.

READ: Elon Musk Finally Debuts ‘Optimus’ Humanoid Robot — But Will He Deliver?

Musk has, through the years, been in a cycle of overpromising Tesla’s AI-powered developments, primarily the contentious Full Self-Driving option. Contrary to what its name suggests, the feature requires a driver to still be at the wheel, with eyes focused on the road and hands ready to take over the vehicle at all times.

Robotaxi expected to dominate

Wood’s excitement hinges largely on Tesla’s Robotaxi which was originally slated to be on the road by 2020 but that target date has since moved to 2024. Wood believes that Tesla is in the position to be “the platform — the primary platform” for autonomous taxis in the US.

“Autonomous taxi platforms, we believe, are the biggest opportunity in the next five to 10 years out there around artificial intelligence,” Wood said, adding that their published target price for Tesla is in the $1,500 to $1,600 range in the next five years.

There are currently no indications of Tesla moving forward with the 2024 target for the Robotaxi, or if they’re moving forward with it at all. The electric carmaker has just recently started finally rolling out the long-delayed Full Self-Driving Beta, and the anticipated update, v11, has just had its release rescheduled again.

Some observers are hoping that there’ll be some kind of news on the Robotaxi at the next Tesla Investor Day on March 1.

Master Plan 3, the path to a fully sustainable energy future for Earth will be presented on March 1.

— Elon Musk (@elonmusk) February 8, 2023

The future is bright! pic.twitter.com/11ug0LRlbD

But if Tesla’s not doing it, it doesn’t me that others aren’t. Alphabet Inc’s (Nasdaq: GOOGL) autonomous taxi platform Waymo, recently expanded its 24/7 driverless service in Downtown Phoenix, while General Motors’ (Nasdaq: GM) driverless platform Cruise also recently expanded from its first location in San Francisco into Austin, Texas and Chandler, Phoenix.

Information for this briefing was found via Fox Business, Insider, Electrek, and the sources and companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.