On November 15 after the regular markets closed, Lucid Group, Inc. (NASDAQ: LCID) reported a giant US$497 million operating loss in 3Q 2021 and an overall cash burn (operating cash flow deficit plus capital expenditures) in the first nine months of 2021 of US$1.045 billion.

The company also announced a few more qualitative positives:

- 1) the Lucid Air won the 2022 MotorTrend Car of the Year;

- 2) Lucid’s (cancelable and refundable) reservations for the Lucid Air have increased to more than 17,000 from around 13,000 as of September 30, 2021; and

- 3) the company reiterated its goal of producing 20,000 electric vehicles in 2022, although management noted that supply chain issues represent a risk to that target.

| (in thousands of US $, except for shares outstanding) | Quarter Ended September 30, 2021 | Six Months Ended June 30, 2021 |

| Revenue | $232 | $487 |

| Operating Income | ($497,050) | ($547,712) |

| Cash – Period End | $4,796,880 | |

| Debt – Period End | $7,955 | |

| Shares Outstanding (Millions) | 1,641.6 |

In after-hours trading on November 15, the stock market decided to continue its recent pattern of emphasizing the more qualitative positives and assigning little weight to Lucid’s enormous current and projected multi-year cash burn rates, as the stock rose slightly to US$45.26. Lucid, which recorded US$0.23 million in revenue in 3Q 2021, has a stock market capitalization and an enterprise value of around US$73 billion and US$68 billion, respectively.

Some of the key aspects of Lucid’s earnings release are as follows:

Lucid’s 17,000+ reservations — they are really not orders — represent about US$1.7 billion of future revenue if all reservations were to become transactions. The company’s ratio of its enterprise value to its entire “order book” is then 40x, an extraordinarily high figure regardless of industry.

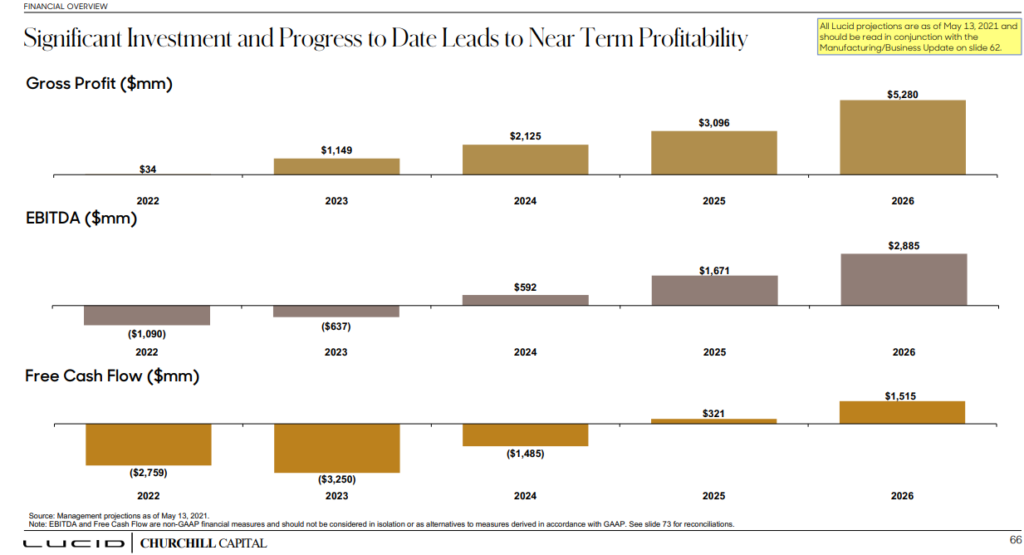

For the first time since it announced its SPAC merger with Churchill Capital Corp IV in February, Lucid did not include (highly optimistic) five-year financial projections in its investor presentation slides. Previous projections called for EBITDA to swing to positive US$2.9 billion in 2026 from a US$1.1 billion deficit in 2022. (Of course, the lack of inclusion of such projections does not necessarily mean that Lucid no longer expects such results.)

Vehicle production began in 3Q 2021 at the company’s advanced manufacturing plant in Casa Grande, Arizona. Casa Grande’s capacity is about 34,000 vehicles per year. By year-end 2023, that annual capacity could increase to 90,000 units.

Lucid’s stock market capitalization has been soaring recently, first based on a step increase in investor sentiment without significant accompanying news, and then on the giant valuation that investors have assigned to a competitor, Rivian Automotive, Inc. (NASDAQ: RIVN). Lucid now trades at an enterprise value-to-2026E EBITDA valuation (based on prior 2026E company projections, which may not still be valid) of more than 23x. Very few growth companies are accorded such a valuation — much less companies with essentially no current revenue.

Investor sentiment toward the electric vehicle sector could remain ebullient for some time. Traditional valuation techniques have not proved especially applicable in this sector for some time.

Lucid is a highly speculative stock. On most valuation measures, it looks quite expensive. Nothing in its third quarter earnings report points to some positive aspect of the company which investors have heretofore not appreciated.

Lucid Group, Inc. last traded at US$44.88 on the NASDAQ.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.