Negative news continues to swirl around Lucid Group, Inc. (NASDAQ: LCID). According to various media reports, six high-level executives, including the VP of global manufacturing and the head of its Arizona operations where the company produces all its vehicles, have recently left the company. All six were involved in Lucid’s manufacturing/logistics processes.

The departures of many high-ranking managers seem unusual for a company which is just beginning to produce electric vehicles on a commercial scale and which appears to have strong growth prospects. Executives should, in theory, be inclined to stay as the equity-linked portion of compensation packages become more valuable as the growth materializes and the underlying share price rises.

These departures may be linked to Lucid’s early August announcement that it slashed its full-year 2022 production to 6,000-7,000 Lucid Airs from its previous manufacturing forecast of 12,000-14,000 vehicles. Note that Lucid produced only 1,405 vehicles in 1H 2022, so production will need to approximately quadruple in the second half to meet even the reduced full-year goal.

| (in thousands of US $, except for shares outstanding) | Full-Year 2022 Guidance | June 30, 2022 | March 31, 2022 | December 31, 2021 | September 30, 2021 |

| Lucid Air Vehicles Delivered | 679 | 360 | 125 | 0 | |

| Lucid Air Vehicles Produced | 6,000-7,000 | 1,405 | |||

| Revenue | $97,336 | $57,675 | $26,392 | $232 | |

| Operating Income | ($559,199) | ($597,530) | ($485,684) | ($497,050) | |

| Operating Cash Flow | ($513,628) | ($494,639) | ($312,733) | (A) | |

| Capital Expenditures | ($2,000,000) | ($309,800) | ($185,082) | ||

| Adjusted EBITDA | ($414,082) | ($383,781) | ($299,583) | ($244,962) | |

| Cash – Period End | Sufficient liquidity well into 2023 | $4,294,082 | $5,391,844 | $6,262,905 | $4,796,880 |

| Debt – Period End | $1,999,234 | $1,998,571 | $1,997,057 | $7,955 | |

| Shares Outstanding (Millions) | 1,668 | 1,668 | 1,648 | 1,642 |

Separately, in late August, Lucid filed an S-3 registration statement with the SEC that would permit it to issue up to US$8 billion in new capital (presumably much of it new equity) over a three-year period. The filing also allows its core investor, a Saudi Arabian investment fund which owns a 60+% stake in Lucid, the flexibility to sell some or all of its 1.0 billion Lucid shares over time. None of the proceeds from any Saudi stock sales would flow to Lucid.

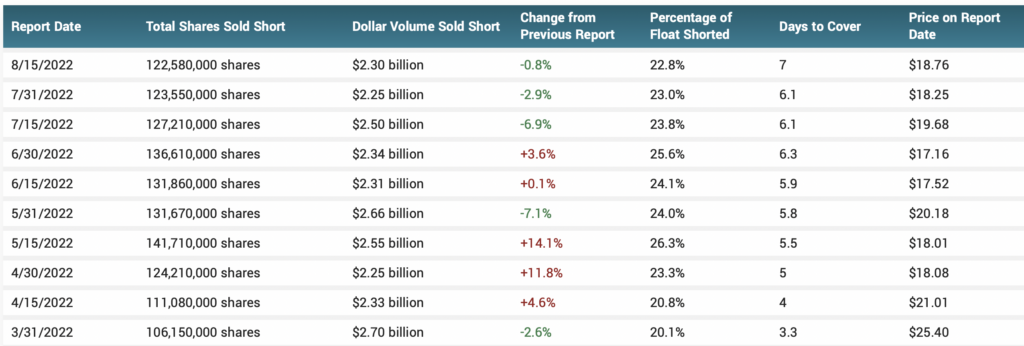

Lucid is one of the most heavily shorted U.S.-traded stocks. As of August 15, 2022, approximately 23% of its float was shorted. In addition, the cost to borrow Lucid shares to put on or to maintain a short position is quite expensive, a reported annual rate of about 11%. Consequently, investors should be mindful that a short squeeze could happen anytime.

Interestingly, Lucid’s overall short position did not vary significantly even during the stock’s strong (bear market) rally in July and the first half of August. Many analysts believe that aggressive short covering fueled those gains.

Lucid’s valuation remain quite high regardless of the headwinds it faces, including the potential of a near-term equity offering. Its enterprise value is US$22.7 billion despite a cash burn (operating cash flow deficit plus capital expenditures) of around US$1.5 billion just in the first half of 2022, with perhaps an even greater level likely in 2H 2022.

Lucid Group, Inc. last traded at US$15.08 on the NASDAQ.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.