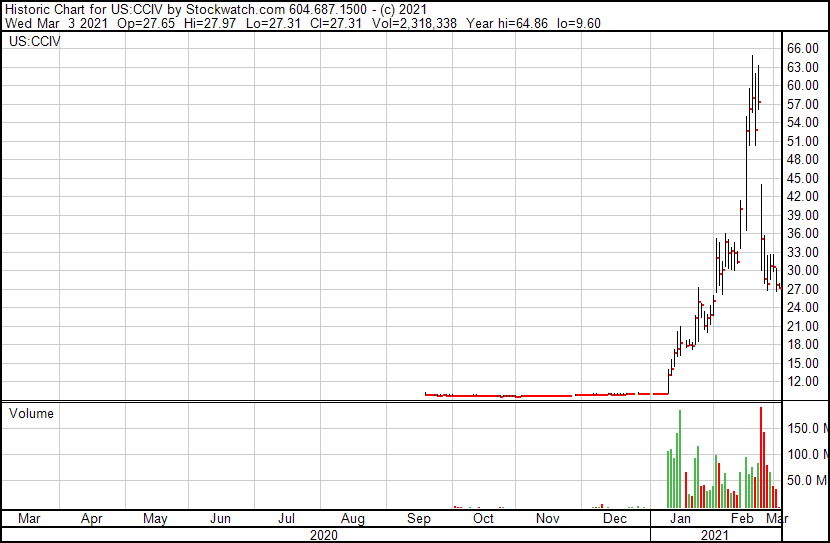

A special purpose acquisition company (SPAC) deal that was finalized on February 22 between Churchill Capital IV (NYSE: CCIV) and the private luxury electric vehicle (EV) start-up company, Lucid Motors, could be a red flag for the generous valuations accorded to many pre-revenue participants in the EV space, including car makers and junior miners. On February 23, the first day the market could react to the terms of the deal, CCIV shares collapsed by 39% to US$35.21.

In a SPAC, a group of investors raise money for a shell company with no underlying business. The SPAC then goes public and begins to search for a company to acquire. When the public SPAC finds a target and reaches a deal, the SPAC and the target reach out to outside investors for funds which is called a PIPE (private investment in public equity). The PIPE investors get a large equity stake, and the SPAC investors get stock in the acquired company, which becomes the publicly traded entity.

The chief advantages of a SPAC are that its structure allows companies to provide forward-looking projections and that its creation allows companies to be publicly traded much faster than in a formal IPO process. Over the last few months, many of the SPAC targets have been in the fintech space. In most cases, these valuations are predicated on rosy out-year revenue projections. SPACs which have successfully raised money have convinced investors those future sales estimates are reasonable.

Refocusing to Lucid, the equity value of the February 22 Churchill Capital-Lucid deal was announced at US$16.3 billion, and existing Lucid shareholders will receive a value of US$11.75 billion. Factoring in the stakes of the PIPE investors and the original Churchill Capital SPAC investors, the deal values Lucid Motors at US$24 billion. When the deal closes, likely in 2Q 2021, the stock will trade under the symbol LCID.

The concerns regarding Lucid’s giant valuation are numerous.

Lucid is a pre-revenue company. It will not deliver its first Lucid Air model to customers until the second half of this year. The Lucid Air’s price starts at US$69,900, after a potential US$7,500 tax credit.

According to its own projections, Lucid will not turn EBITDA positive and free cash flow positive until 2024 and 2025, respectively. By 2025 and 2026, the company hopes to realize gross margins of 22-23%, far less than the margins earned by leading technology companies. By 2026, the company hopes to generate US$2.9 billion of EBITDA and US$1.5 billion of free cash flow. Even based on those figures, Lucid is trading at 16x 2026E free cash flow.

Lucid plans to sell 20,000 EVs in 2022. According to management, that figures ramps in more or less a straight line to 251,000 cars by 2026. No production issues, such as parts shortages, or labor issues are foreseen.

In comparison, NIO Inc, an established Shanghai, China-based premium EV manufacturer, delivered 7,225 vehicles in January 2021 and, as of the end of January 2021, had delivered a total of 82,866 units since the company’s inception. NIO had nearly US$8 billion of revenue in 2019.

To put all this in perspective, NIO’s enterprise value is about US$86 billion, implying that Lucid is already valued at 28% of NIO, an established EV producer, even though it has yet to sell a vehicle or record a dollar of revenue.

Other EV start-ups, such as Nikola, Fisker and Lordstown Motors began trading publicly over the last 12 months via SPAC transactions. However, none of these companies achieved a pro forma valuation of even US$4 billion.

Consequently, and most importantly, if Lucid’s seemingly stretched valuation were to correct from US$24 billion over the next few months, it is possible that could impact the valuations of other EV-related stocks.

Churchill Capital IV Corp. (NYSE: CCIV) is trading at US$26.98 on the NYSE.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

4 Responses

And how about those insane Tesla valuations? When one EV manufacturer is worth more than the rest of the Top 10 worlds car manufacturers combined? Lucid has all the resources, the Team, unlimited Saudis money to make it happen, and it will.

Good morning.,So what is actually the process and how long does it take to take a new company through this process in Canada.where should one be looking for detailed info.?

Thanks , Alex .

Your story sucked because it did not truthfully depict how horrendously scandalous the merger deal via slack actually was for retail investors. This is a text book example of why regular everyday investors steer clear of the corrupted and boarder line criminal manipulation of public markets. Everytime such companies are. Permitted to oversell they’re stock predicated on unrealized forward earnings, retail investors are fleeced, robbed and discarded. The lucid merger was a bloodbath, and the current PPS and stock chart reveals this truth. The ceo and Klien the broker of this botched deal are fully culpable for this deception, and will forevermore be known untrustworthy at best. They single handidly destroyed SPAC investing by retail investors.

In more common terms it’s called a SCAM.

Agree 100%