On Thursday, Lululemon Athletica Inc. (Nasdaq: LULU) reported its first-quarter financial results for 2022. The company saw its revenues grow 32% to $1.6 billion, marking Lululemon’s fastest-growing revenue quarter in 9 months. The company saw its cost of revenue grow 41% to $745.27 million, indicating the company is dealing with rising inflation. This puts the company’s gross profit at $868.2 million, or a 25% increase year over year.

The company also saw its income before taxes grow 34% to $260.33 million, and it reported earnings per share of $1.48, up 31% year over year.

The company said that comparable-store sales were up 24% and their direct-to-consumer segment was up 32% year over year. The firm ended the quarter with $649 million in cash and cash equivalents, while inventory stood at $1.3 billion, up 74% year over year.

Lululemon also provided a 2022 outlook this quarter. The company said it expects revenues for the second quarter to come in the range of $1.75 to $1.775 billion, while earnings per share should come in between $1.89 and $1.94. For the full year, the company is guiding for revenue to come in between $7.61 and $7.71 billion, and earnings per share should come in the range of $9.42 to $9.57.

Lululemon currently has 32 analysts covering the stock with an average 12-month price target of $432.22, or an upside of 40%. Out of the 32 analysts, 10 have strong buy ratings, 13 have buy ratings, 8 analysts have hold ratings and a single analyst has a strong sell rating on lululemon. The street high price target sits at $541, or an upside of 80%.

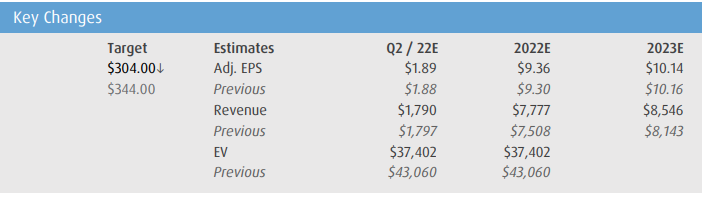

In BMO Capital Markets’ note on the results, they reiterate their market perform rating and slash their 12-month price target from $344 to $304, saying that although revenues “continue to defy retail gravity,” the company is seeing inflationary pressures hit margins.

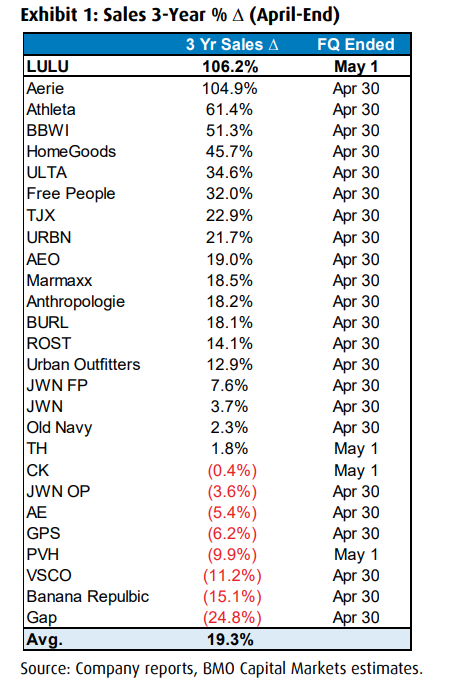

On the top-line result, Lululemon beat the street’s estimate of $1.546 billion and says that the sales grew 106% on a 3-year basis, outgrowing every other comparable retailer.

BMO says that they expect Lululemon to beat both their second quarter and full-year guidance, saying that the company has a “consistent history beating street expectations and their guidance.” While they note that since 2017 the company has beat the high end of guidance 94% of the time.

However, the company’s gross margin of 53.9% missed street estimates by 1%, and slid 3.2% year over year. This margin compression primarily comes from a 3.4% increase in air freight costs and 0.1% for unfavourable foreign exchange prices.

BMO says that the company had a slightly better SG&A leverage this quarter, which primarily came from their online stores. Though BMO notes that the SG&A was slightly hit by an increase in strategic investments.

Lastly, BMO notes that Lululemon’s inventory has increased 74% year over year, and believes that this is not the last quarter of a high increase in dollar/unit increases. They expect it will slow down next quarter, but note that a decent amount of the lift in inventory comes from costs. They say “the spread between growth in inventory cost vs. units suggests a ~mid-teens lift in cost.”

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.