Lumber prices have plummeted to around $500 per thousand board feet, marking a stark departure from the soaring prices witnessed in recent years. The latest data from industry sources paints a picture of diminishing demand, particularly from the vital property sector.

At the start of April, lumber sales volumes remained notably subdued, a departure from the usual surge in demand typical for the spring season. Traditionally, this period sees heightened activity in wood framing materials, but the prevailing circumstances have been far from ordinary for approximately four years.

Lumber…

— Ian McMillan, CMT (@the_chart_life) April 18, 2024

😳$LBR_F https://t.co/J3MnTMllZo pic.twitter.com/TLdeiA1d87

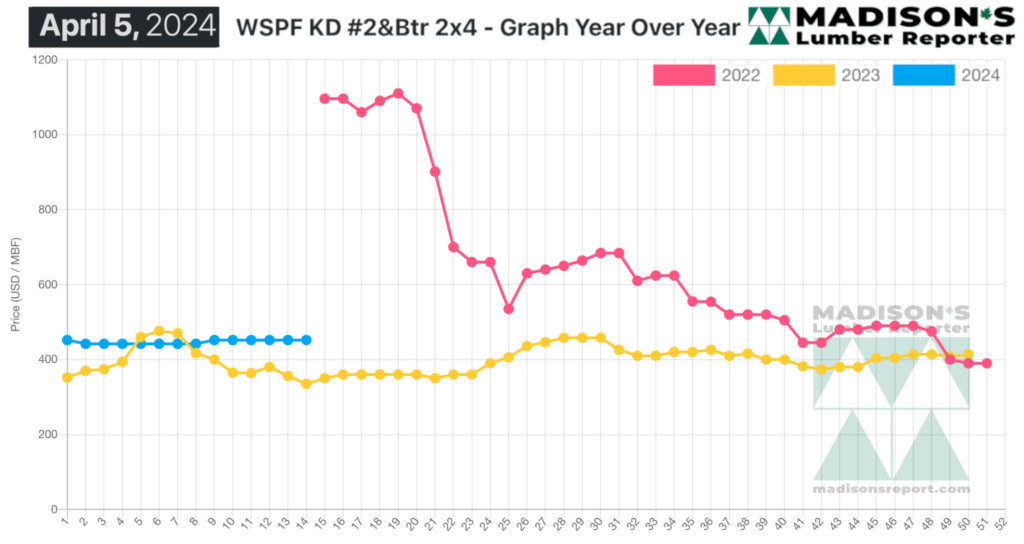

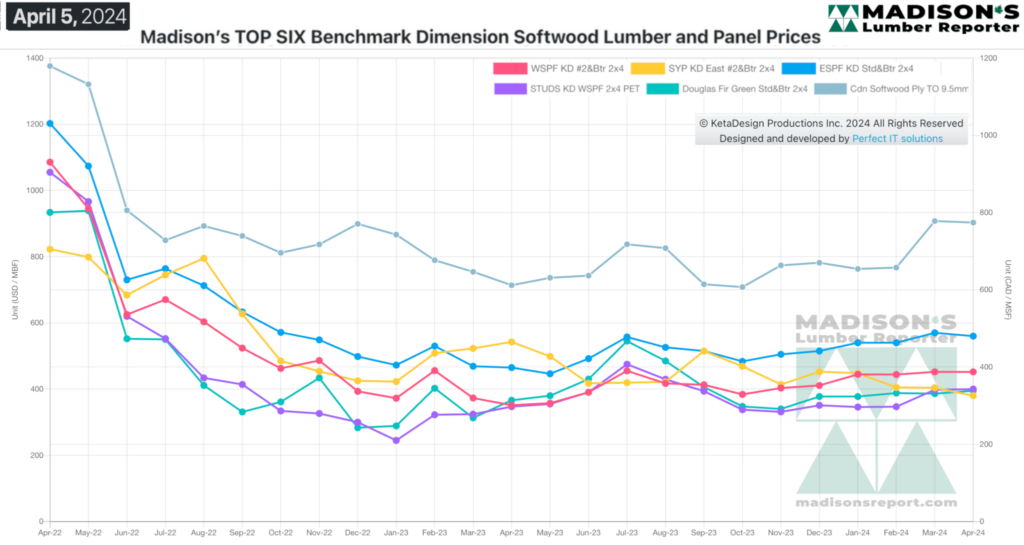

Following the unprecedented highs of lumber prices from 2020 to 2022, characterized by extreme volatility, the market has undergone a dramatic shift. Throughout 2023, prices stabilized, mirroring the cyclical patterns observed in previous years. However, 2024 has presented a different narrative, with prices largely remaining flat, albeit slightly above levels seen a year ago.

The week ending April 5, 2024, saw benchmark softwood lumber item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) maintaining a price of US$452 per thousand board feet, consistent with the previous week and month. This stagnation contrasts sharply with the $335 per thousand board feet recorded during the same period last year, representing a significant increase of 35 percent.

Similarly, Southern Yellow Pine East Side 2×4 #2&Btr KD (RL) witnessed a decline to $380 per thousand board feet, down three percent from the previous week and six percent from one month ago. This downward trend is further underscored by a substantial 30 percent decrease compared to prices from the corresponding week in the previous year.

Several factors contribute to this downturn, including weakening demand in the construction sector, particularly evident in housing starts in key markets like the US and Canada. March figures fell sharply below forecasts, signaling a dampened outlook for future demand for building materials.

Moreover, despite a surge in Canadian lumber production by 16.4 percent year-over-year in January 2024, sales growth has lagged at 11.2 percent. This oversupply, coupled with muted demand, exerts further downward pressure on prices.

Adding to the economic headwinds are strong US economic indicators and hawkish signals from Federal Reserve officials, which have dimmed expectations of interest rate cuts. A tightening monetary policy translates to higher mortgage rates, dampening the prospects for construction activity and exacerbating the challenges facing the lumber market.

Information for this briefing was found via CFI, Maddison’s Report, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.