On October 27, Lundin Gold Inc. (TSX: LUG) reported their third quarter 2021 results, the company reported revenues of US$756.4 million, an increase from the US$6000.7 million last year. Gross profits also grew to US$303.9 million from US$199.3 million. Additionally, the company had a positive free cash flow of US$407 million and earnings per share of US$0.24. As of September 30th, the company had net cash of US$390.7 million.

Many analysts lowered their 12-month price target after the results, bringing the average between all 23 analysts to C$12.94 from C$13.38, which represents a 24% upside. Out of the 23 analysts, 3 have strong buy ratings, 7 have buys, 12 have hold ratings and a single analyst has a sell rating. The street high sits at C$17 while the lowest comes in at C$9.

In BMO Capital Market’s third quarter review, they reiterate their C$15 price target and market perform rating, saying that the company needs to navigate through this challenging period. They write, “We expect that the improvements could make meaningful improvements during 2022.”

For the results, BMO says that Lundin slightly missed their estimates due to lower expectations at Candelaria, Chapada, and Eagle. While Zinkgruvan and Neves-Corvo exceeded their revenue estimates.

They additionally say that Lundin continues to build cash and expects management to go into detail on their strategy for capital allocation, which BMO expects an NCIB (share buybacks), dividend or M&A.

They say that the projects already under development when finished will deliver significant value to the company, and they except the company to highlight such value. They also expect the company to update investors on the growth of project ZEP and the Chapada mine, as well as provide an update on the progress at the Candelaria mine.

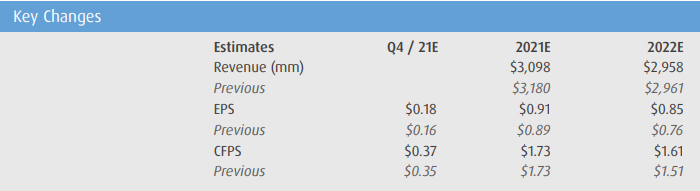

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.