Lyft Inc (NASDAQ: LYFT) opened up 2.5% higher Tuesday morning following the release of its latest financing results, before ultimately closing down 6.34%. The company reported revenues of $609 million, beating Refinitiv estimates, but came short in earnings per share estimates with the company reporting -$1.31 earnings per share.

A number of analysts changed their price target on Lyft after their earnings, bringing its average 12-month price target slightly higher from $67.60 to $68.45 with a total of 41 analysts covering the name.

Below are the most recent analyst changes as of the time of writing.

- UBS raises target price to $70 from $65

- Stifel raises target price to $60 from $55

- D.A. Davidson raises target price to $72 from $66

- Piper Sandler cuts target price to $86 from $88

- Truist Securities raises price target to $76 from $70

- Atlantic Equities raises target price to $62 from $57

- Deutsche Bank raises target price to $75 from $69

- Morgan Stanley raises price target to $70 from $65

- MKM Partners raises fair value to $63 from $58

- JP Morgan raises target price to $72 from $68

- Credit Suisse raises target price to $76 from $74

In Canaccord’s note sent to clients, their analyst Michael Graham says these earnings show that Lyft is still in the early stages of recovery. Graham says that Lyft is executing “impressive cost discipline’ which is showed by their EBITDA beat and further reduction in expenses.” He adds, “We continue to like the set up for Lyft shares here and expect a return to revenue growth to be accompanied by significant operating leverage, along with the real potential for multiple expansion as Lyft has been largely left behind the race towards higher multiples seen with most other large-cap technology names.”

Graham says that although Lyfts revenue dropped 36% year over year, the company reported that they are seeing growth in demand every month with March showing the steepest recovery. The demand has been driven by cities with high vaccination rates. Because of this, demand is starting to outpace supply which is leading to a new record high for revenue per active rider.

Graham says that the company is coming out with incentives and organic tailwinds to boost driver supply, and that the company expects the supply-demand imbalance to continue throughout the second quarter. Management calls this imbalance transient which will then level off by June.

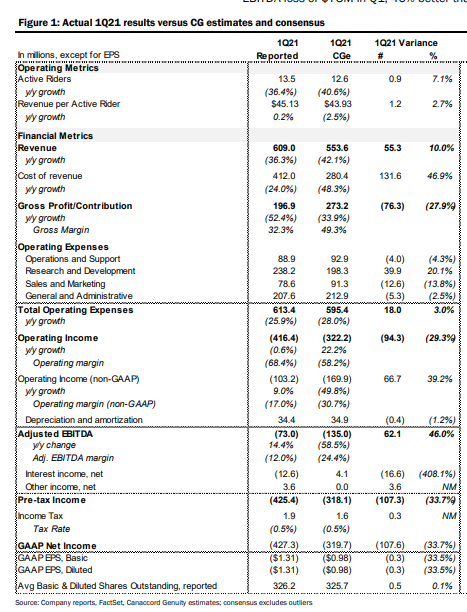

Below you can see Canaccord’s estimates and how Lyft did against their estimates. Revenue came in 10% above their estimates while active and revenue per rider beat by 7% and 2.7% respectively.

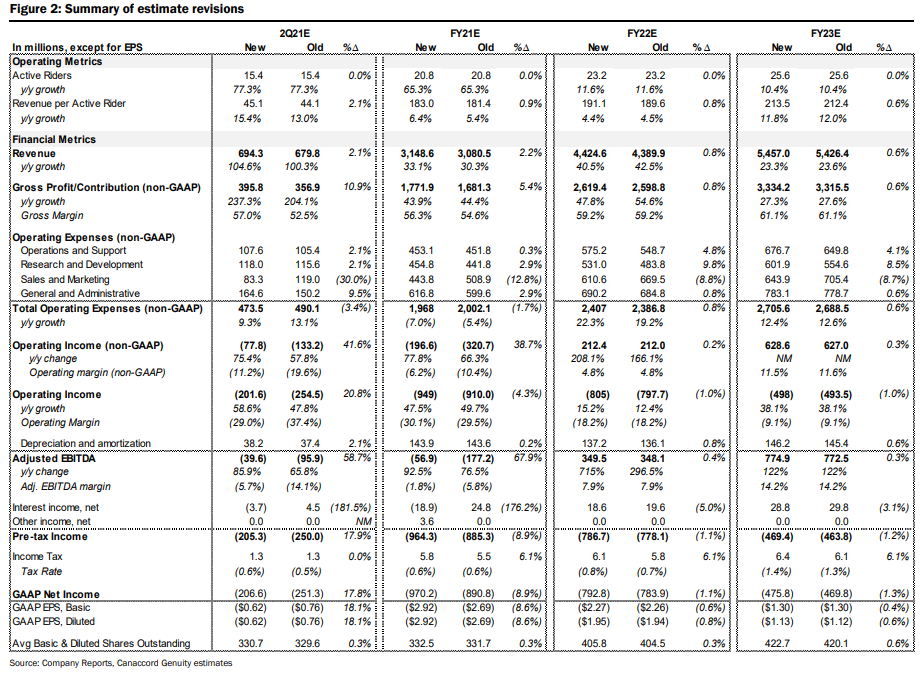

Additionally, you can see Canaccord’s updated 2021-2023 estimates wherein profitability numbers were the main change since Lyft showed cost controls and a suppressed sales and marketing expense.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.