On December 27th, MAG Silver (TSX: MAG) provided an update on the Juanicipio project. MAG Silver announced that the Comisión Federal de Electricidad notified their joint venture partner Fresnillo that the approval for its tie-in to the national power grid cannot be granted. MAG Silver expects this to delay the project by 6 months and notes that this delay was driven by the Comisión Federal de Electricidad not having adequate staff during the pandemic.

MAG Silver currently has 10 analysts covering the stock with an average 12-month price target of C$28.03, or a 42% upside to the current stock price. Out of the 10 analysts, 7 have buy ratings while the other 3 have hold ratings. The street high sits at C$33.12 from Roth Capital while the lowest comes in at C$23.50.

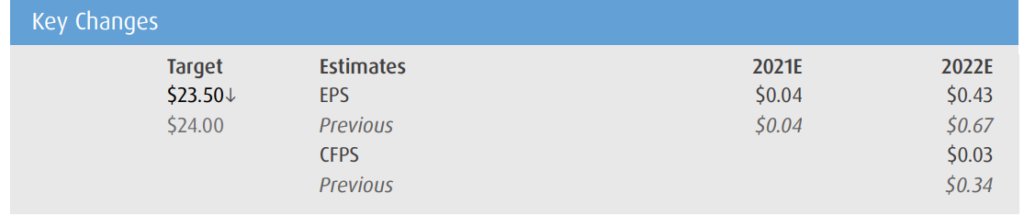

In BMO Capital Markets’ note, they reiterate their market perform rating but lower their 12-month price target to $23.50 from $24.00, saying that the 6-month delay equates to a reduction in their NAV by 2.5%. They call the news disappointing but believe that with MAG’s recent equity financing, the company has an adequate balance sheet to take on this setback.

BMO says that this delay puts the commissioning timeline to be approved sometime after the first week of May 2022 and MAG Silver will continue to process mineralized materials at the Saucito and Fresnillo plants. BMO notes that over the last 5 quarters, production has averaged 438,000 ounces per quarter of silver.

Lastly, BMO says that since 2022 guidance was never provided for Juanicipio, they are only slightly lowering their 2022 estimate. Lowering 2022 production to 10.1 million ounces, of which 4.4 million ounces is attributed to MAG, equates to a -2.5% NAV decrease to $913 million.

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.