The Trump administration is reportedly weighing tariffs on copper imports in a bid to reinvigorate domestic production. Commerce Secretary Howard Lutnick confirmed that President Donald Trump has ordered an investigation of the Section 232 of the Trade Expansion Act of 1962 into copper imports, laying groundwork for possible tariffs.

The initiative, modeled after his steel and aluminum tariffs, is pitched as a national security measure to “bring production back” to America. While no rate is finalized, officials signal that broad duties could be imposed with “no exemptions.” Market watchers speculate the tariff could range from 10% to as high as 25%, mirroring the steel import levy.

Make Copper American Again. https://t.co/VNu4YT7D7E

— Brandon Beylo (@marketplunger1) February 25, 2025

“It’s time for copper to come home,” Lutnick said.

For much of the 20th century, the US was a leading copper producer. Over time, however, the industry lost ground amid rising labor costs, stricter environmental regulations, and competition from lower-cost mines abroad. By the late 1900s, U.S. copper companies faced falling prices and new EPA rules that increased operating costs. As a result, US miners’ share of world copper output has shrunk sharply since the mid-20th century, producing roughly 850,000 metric tons of refined copper in 2024, with Arizona alone accounting for about 70% of output.

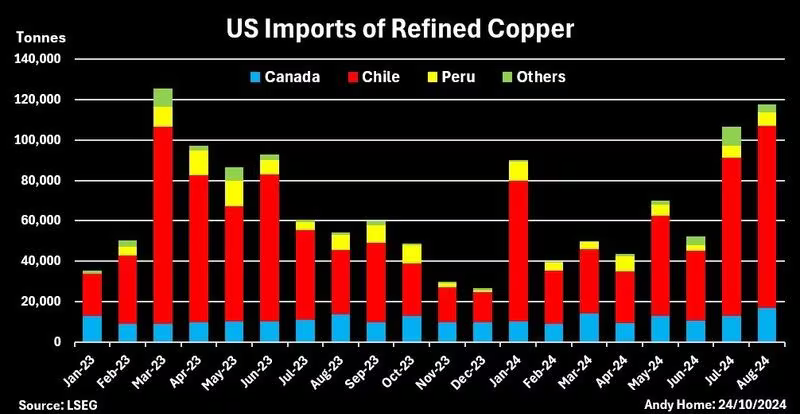

Domestic supply falls short of demand – an estimated 45–50% of US copper consumption is met by imports, with top suppliers including Chile, Canada, Mexico, and Peru.

Anticipation of tariffs has already driven US copper prices higher. Copper prices approached $4.70 per pound after Trump’s tariff threats, creating a widening gap with London prices. On the other hand, one report notes the tariffs “risk raising costs for American manufacturers while dampening global demand” for copper.

Should the tariffs push through, significant hurdles remain in reviving domestic production. Industry experts note it can take 10+ years and over $5 billion to develop a new copper mine from scratch.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.