In an October 19 announcement with little industry precedent, Mako Mining Corp. (TSXV: MKO) announced a dramatic 70% reduction in the mineral resource estimate of its primary asset, the San Albino gold project in Nicaragua. A third-party consultant now estimates the project contains about 279,000 ounces of gold, down from a 2015 estimate of about 939,000 ounces. The key reason: based on drilling results over the past few years, gold vein mineralization is substantially less prevalent than initially assumed.

The reason for this, in short, is that the original estimate assumed that the halos surrounding gold bearing veins contained similar gold content. However, those halos are now viewed as being low grade, which has significantly reduced the estimated resource. The company is working under the assumption that additional drilling will likely enable the mineral resource to be upgraded and expanded.

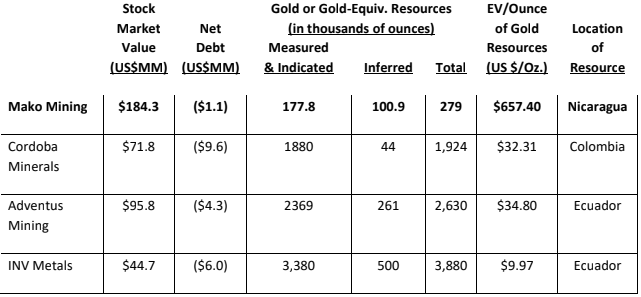

| 2015 Estimate (ounces) | 2020 Estimate (ounces) | % Change | |

| Measured & Indicated | 152,000 | 177,800 | 17% |

| Inferred | 787,000 | 100,900 | -87% |

| Total | 939,000 | 278,700 | -70% |

What is especially unusual about this resource estimate change is the infrequency of its occurrence across the mining industry. Such estimates are rarely revised lower; indeed, projections are frequently re-rated higher prior to production. Furthermore, commercial gold production at San Albino is scheduled to begin in January 2021, and this production decision was presumably based on the 2015 estimate. Assuming a 500 tonnes-per-day (tpd) mineral resource mining rate (which was reflected in the project’s 2015 Preliminary Economic Assessment), the mine’s Measured and Indicated resources would be fully depleted in just three years.

After reflecting this new resource estimate, Mako shares trade at about a 2000% premium to a group of similarly positioned junior miners on the basis of enterprise value-to-estimated gold resources. We include in this group pre-production junior miners which have their principal mining project located in Latin America and which have recorded mineral resource estimates.

A 2015 Preliminary Economic Assessment (PEA), which was based on the mineral resource estimate from that same year, estimated that the San Albino project had an after-tax net present value (NPV) of just over $100 million and a 50+% internal rate of return (IRR), based on a mineral resource production rate of 500 tpd. If Mako Mining were to adjust the PEA to reflect the lower resource level, these figures would have to be cut significantly.

As noted above, Mako Mining expects to begin commercial gold production at San Albino in January 2021, so the company will likely begin recording positive cash flow at that time, particularly given the robust gold price environment. In addition, San Albino is characterized by high-grade gold (10+ grams per tonne of resource according to the October 19 mineral resources estimate) and, given that it will be an open-pit mine, San Albino is expected to have low per tonne operating costs.

As a result, the company should realize an attractive level of profit per tonne mined when production commences. In addition, the company is debt-free and has about $1 million of cash on its balance sheet.

Due to the quality of the San Albino resource and a near-term commencement of gold production, Mako Mining’s valuation per tonne of resource was significantly higher than its Latin America-focused junior mining peers – before the cut in its estimated mineral resources. Now, as the quantity of San Albino’s potential mineral resources are deemed to be significantly smaller, this premium has been stretched to a much higher level.

Production at the project should commence in a few months, but given this lower mineral estimate, the mine may only have a life of a few years.

Mako Mining is trading at $0.36 on the TSX Venture Exchange.

Information for this briefing was found via Sedar and Mako Mining Corp. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Mako has a unique mining approach, mining only the vein, with 20 cm dilution. San Albino veins are 0.65 meters wide, note the next sector Aras veins are 1.3 meters wide; thus grades are running 15 to 20 grams/tonne. Above 2020 reserves are from only 2% of property, likely Mako can keep exploration ahead of production.

John Clark.