Mako Mining (TSXV: MKO) has taken a tumble in morning trading today following the announcement that it will be acquiring Goldsource Mines (TSXV: GXS). The transaction, which is to take the form of an all-stock deal, is expected to turn Mako into a geographically diversified gold operator.

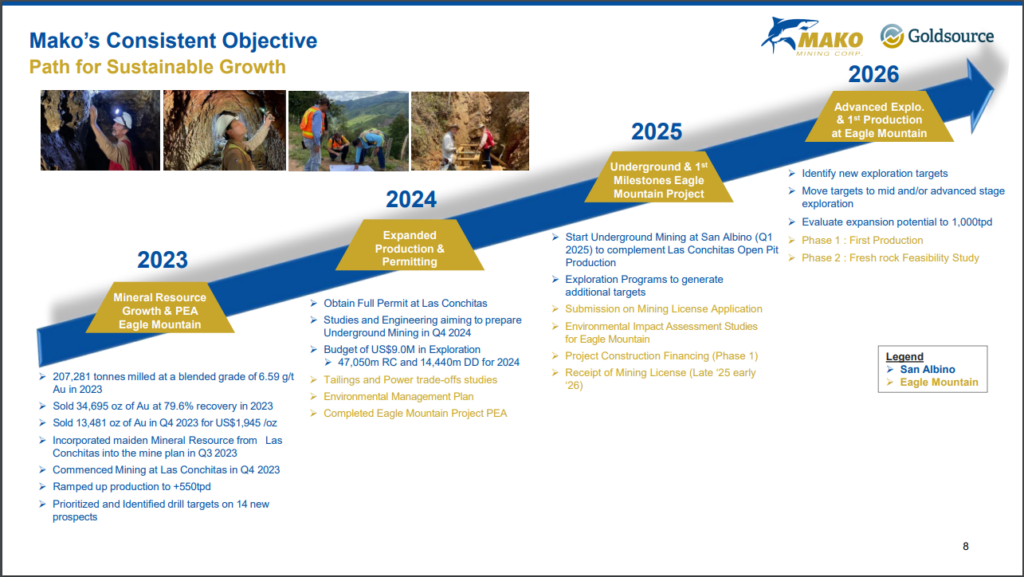

The purchase will see Mako acquire the Eagle Mountain project, which is found in Guyana. The project boasts a net present value (5%) of US$292 million based on a preliminary economic assessment released in January, based on a gold price of US$1,850 an ounce and a fifteen year mine life. The estimate is based on a shallow open-pit mining model, with Mako anticipating to accelerate the development of the project into a mine with its proven engineering and construction teams.

Mako currently anticipates that cash flow from its San Albino mine in Nicaragua will be utilized to accelerate the development of Eagle Mountain, and push it to a production decision “as soon as practicable.”

Under the terms of the arrangement, Goldsource shareholders are to receive 0.22 of a common share of Mako for each share held, representing a 52.1% premium to the 20-day volume weighted average price of the equity. Goldsource shareholders are expected to hold 16% of the resulting company. The transaction implies a $33.3 million purchase price.

The resulting issuer will see Akiba Leisman continue as CEO, while Goldsource CEO Steve Parsons will take on the role of President. Eric Fier, executive chairman of Goldsource meanwhile will take on the role of non-executive chairman of Mako. The board is anticipated to comprise of seven members, which includes two nominees from Goldsource.

The transaction is currently expected to close in Q2 2024, subject to regulatory approval. A terminate fee of $1.35 million is also in play, while Mako’s largest shareholder, Wexford, is expected to provide a $2.0 million bridge loan to Goldsource to fund certain activities at Eagle Mountain.

Mako Mining last traded at $2.42 on the TSX Venture.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.