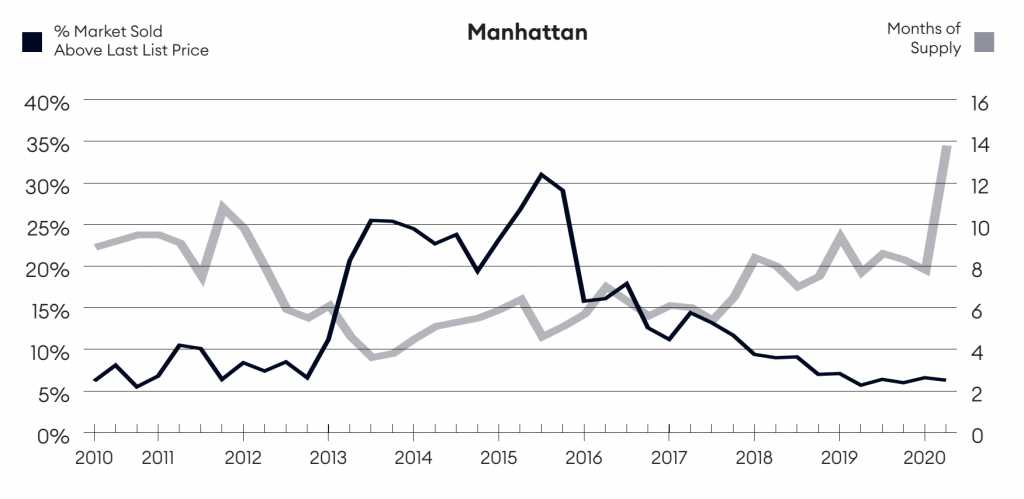

As major cities across the US are under the siege of soaring coronavirus infection rates, civil unrest, and high unemployment levels, city dwellers have sparked a massive migration to the suburbs and rural communities. As such, metro real estate markets have taken a plunge, causing to prices to fall by historic levels.

According to Miller Samuel and Douglas Elliman, the average sale price for an apartment in Manhattan has fallen by 18% to $1 million in the second quarter 2020 when compared to the same time only a year prior. Furthermore, the number of apartments sold in the city have plummeted by 54%, making it the largest drop in over 30 years.

During the onset of the pandemic when much of the US was under some form of lockdown restrictions and stay-at-home orders, many real estate agents were barred from showcasing apartments in Manhattan. As a result, the second quarter only saw a total of 1,147 apartment sales – the lowest ever on record. However, now that many of the restrictions have been lifted in the state of New York, agents have been busy nonstop.

Although the real estate market in Manhattan is bustling once again, it is certainly not the same pre-pandemic atmosphere. With the significant reduction in demand for metro real estate, sellers are forced to reconsider their prices in the context of a new era of an oversupply of rentals and sales. As a result, there is currently a mismatch in pricing between big-city real estate and rural real estate, and if one is looking to get out of chaotic urban dwellings, now is said to be the time – before a price correction overcomes the market once again.

Information for this briefing was found via Miller Samuel and Douglas Elliman, CNBC, and Compass. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.